As mentioned in the last BMS Tropical update issued Sunday, August 22, the hurricane season was just ramping up and the next troubled area would be in the Gulf of Mexico. This should not have been unexpected to the readers here, however, the fact that the industry is now looking at its first major impact of the season is eye-opening.

The 2021 Atlantic hurricane season has been an active one, not just in terms of named storm counts in the Atlantic Basin, but U.S. impacts. Claudette, Danny, Elsa, Fred, and Henri all have made U.S. landfall this year, but thankfully the overall insured loss has been low. Losses are still being tallied from Fred and most recently the impacts to New England from the Hernir landfall this past weekend. It is safe to say that this year has been a high-frequency low-severity U.S. landfalling season so far, with total estimated losses from these five named storms totaling under $1 billion in insured loss.

Grace made landfall this past weekend just north of Veracruz, Mexico as the first major hurricane of the season and showed just how fast storms can intensify given the right conditions. This is precisely why the insurance industry needs to expect the unexpected when it comes to named storm formation and the forecasts of track and intensity. Time and time again we have seen a weak tropical system form in the Western Caribbean like TD 9 has and turn into a monster of a hurricane in the Gulf of Mexico. In fact, yesterday was the anniversary of Hurricane Harvey, which is a classic example of a depression that entered into the Gulf of Mexico and become a major hurricane ending the 12 year U.S. major hurricane landfalling drought. And since that time there have been plenty of other examples like Hurricane Michael in 2018 or even last year’s Hurricane Laura was a tropical storm when it entered into the Southern Gulf of Mexico and made landfall in Louisiana as a major Category 4 hurricane. (Note tomorrow is the one-year anniversary of that landfall). The bottom line is: it is almost an annual occurrence now that a weak tropical system enters the Gulf of Mexico and intensifies up until landfall.

A bit of trivia that the insurance industry may be interested in is the next name on the hurricane list is Ida. The “I” storm is the most retired letter of all the letters. In fact, 11 “I” storms have been retired with the most recent being Irma in 2017. So the “I” storm has a history of causing major problems for the insurance industry.

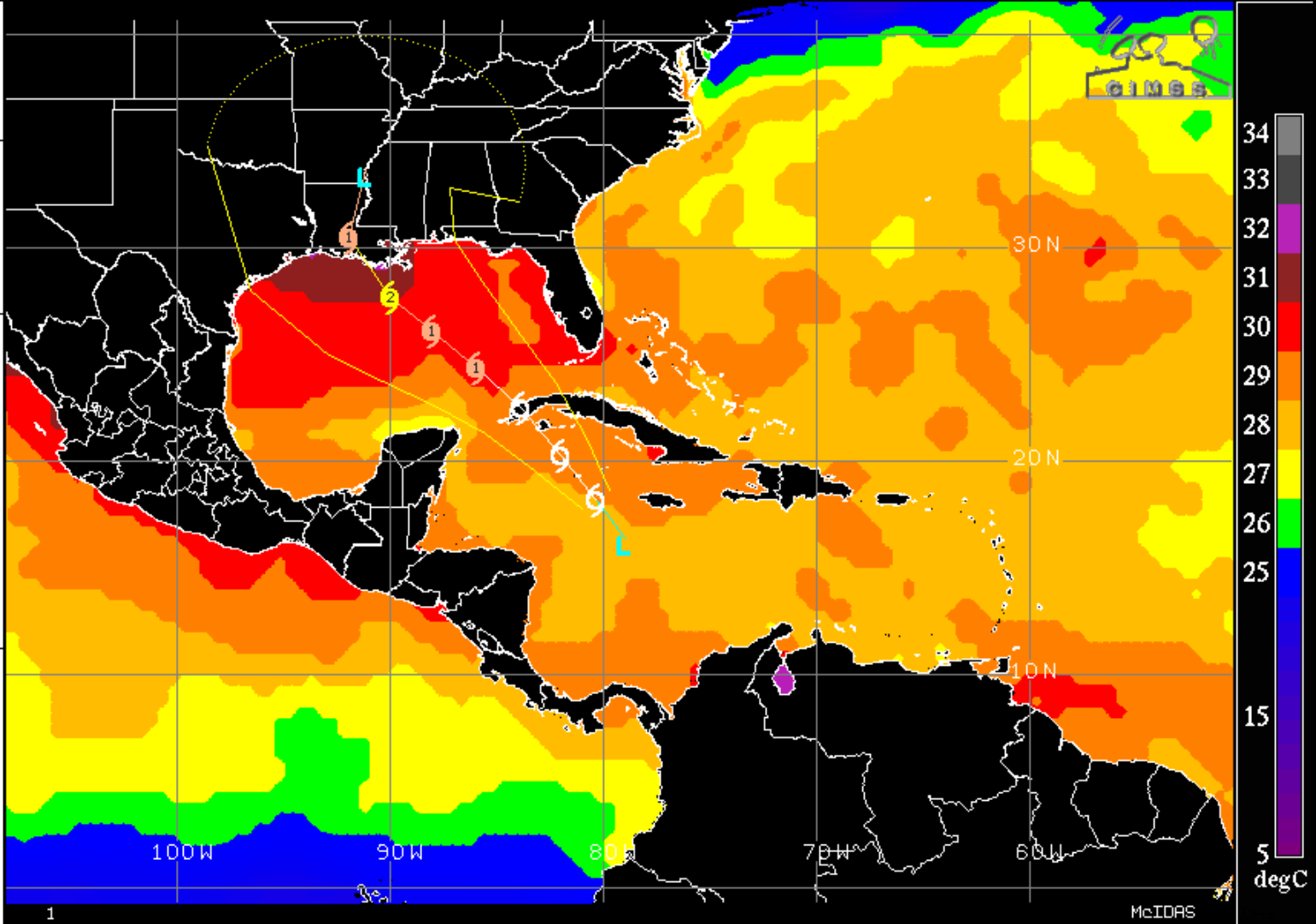

Warm Waters and Intensity

Some of the warmest water in the Atlantic Basin is right along the northern Gulf Coast. Along with all the historical storms mentioned above that have intensified in the Gulf of Mexico, many recent storms intensified right up until landfall. Given that the warm waters range from 87 – 89 degrees F, there is a concern if any named storm enters these waters that rapid intensification can occur.

In fact, with almost no dry air in the region and relatively low wind shear, there does not appear to be a lot of scenarios here where TD 9 does not rapidly intensify in the Gulf of Mexico. In fact, the NHC discussion explicitly discussed this scenario. Overall the intensity forecast is determined by how fast TD9 will organize in the next 24 hours. The slower the organization is over the next 24 hours the weaker the storm at landfall. If rapid intensification can occur sooner the stronger it will be at landfall.

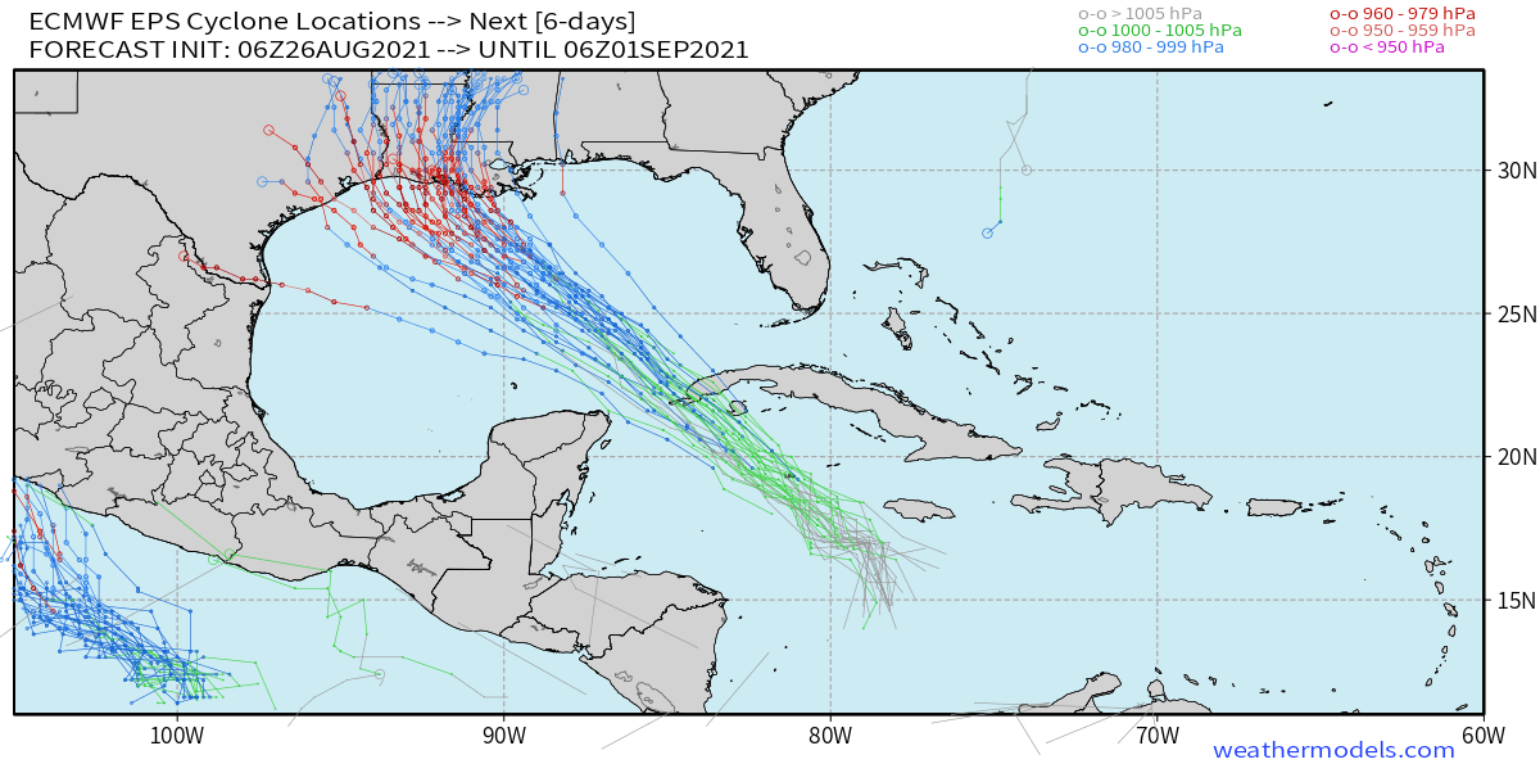

Track forecasts are narrowing in on Central Gulf

Given that potential Ida is still only a tropical depression and a relatively weak system, this will result in wild swings in future track guidance for the system as it tracks into the Gulf of Mexico. What we do know at this point is that most guidance has been trending to tracks to the East. This past weekend the forecast scenarios were focused on a Mexico or Southern Texas landfall. Over the last two days, the scenarios have been shifting North and East up the Texas coastline and most recently the focus has shifted further East towards the Louisiana coastline. This currently seems like the most likely scenario, which is unfortunate given the multiple impacts that occurred in Louisiana last year and many are still recovering. Again at this early stage in the forecast don't focus on the Center of the NHC track, but focus on the Cone as all possible tracks below are still likely possible.

Given the current location of TD 9, there are only 72 hours to prepare for a powerful hurricane. This means preparation needs to start now. The insurance industry should be sharing with their policyholders the great work that the IBHS has done on simple things that they can do to mitigate losses from high wind events. Some of these steps are free and do not cost any money to policyholders and could reduce the damage. An example is closing doors and garage doors during high wind events. In this event, if a window is not boarded up, the glass can break and high winds can enter a building resulting in a pressure difference. Having interior doors closed can give a roof a chance by limiting the area of your house that might fill with air, which would limit upward pressure on the roof to only one area of the structure. There are many other low-cost ways to protect properties as well, but all these steps need to be done now.

Lastly given Louisiana’s multiple impacts last year, hurricane preparation is top of mind. Recovery is still ongoing, but for structures that have made repairs, there is hope that the repairs are fresh and maybe in some cases exceed the codes. This just might help limit insured losses as there are multiple lessons that should have been learned from last year. Zeta (Post analysis was upgraded to Category 3) and Sally (Category 2 at landfall) might be good examples of lower insured impacts and lower loss, due to the impacts from Katrina in 2005. Katrina allowed for many structures to be built to higher standards, which likely resulted in a lower loss had Katrina not happened.

More BMS tropical updates will follow with more insightful impacts on the insurance industry over the next few days.