Over the last several days, these BMS Re tropical updates have highlighted all the uncertainty with intensity and track. It has been a roller coaster of scenarios from a major hurricane hitting the populated west coast of Florida to a weak Apalachee Bay hurricane having minimal impact on the insurance industry. Today this BMS tropical update can start to narrow down the options to two possible scenarios that are the most likely to occur as Ian tracks towards the Florida coastline later next week. The current strength of Ian could be critical to one of these possible scenarios.

This morning U.S. Air Force Reserve hurricane hunters are finding Ian has an elongated center and is still in an organizing stage without much true inner core. This could slow intensification initially, but as these updates had been saying since Monday last week, the overall environment still looks favorable for rapid intensification.

The other issue with the current sluggish development mentioned in past tropical updates is that the weaker the system in the western Caribbean, the more likely it would track to the west. We are seeing the overall tracks shift to the west later in the forecast period when Ian is in the eastern Gulf of Mexico later next week.

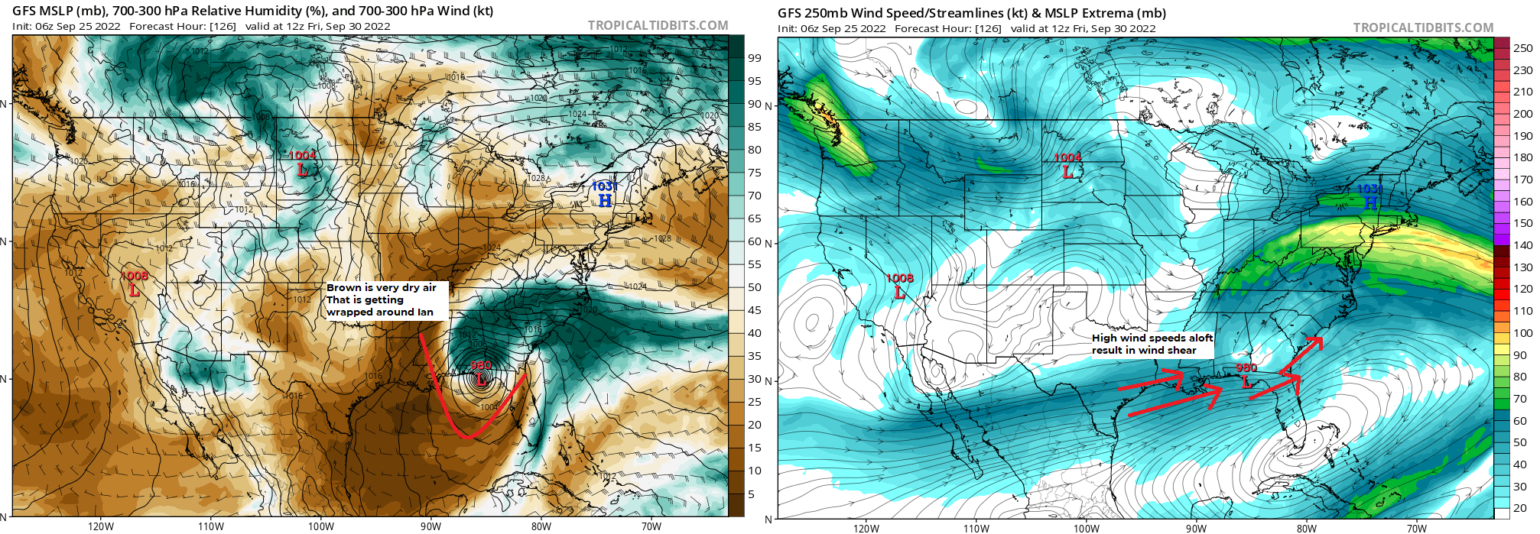

The other recap just mentioned in yesterday’s tropical update was that there was an increasing chance that dry air and wind shear could start impacting Ian if it tracked further north in the Gulf of Mexico. This could provide considerable weakening before landfall. This has occurred with other past storm such as Hurricane Lili (2002), Ida (2009), Katrina (2005), and most recently with Irma (2017).

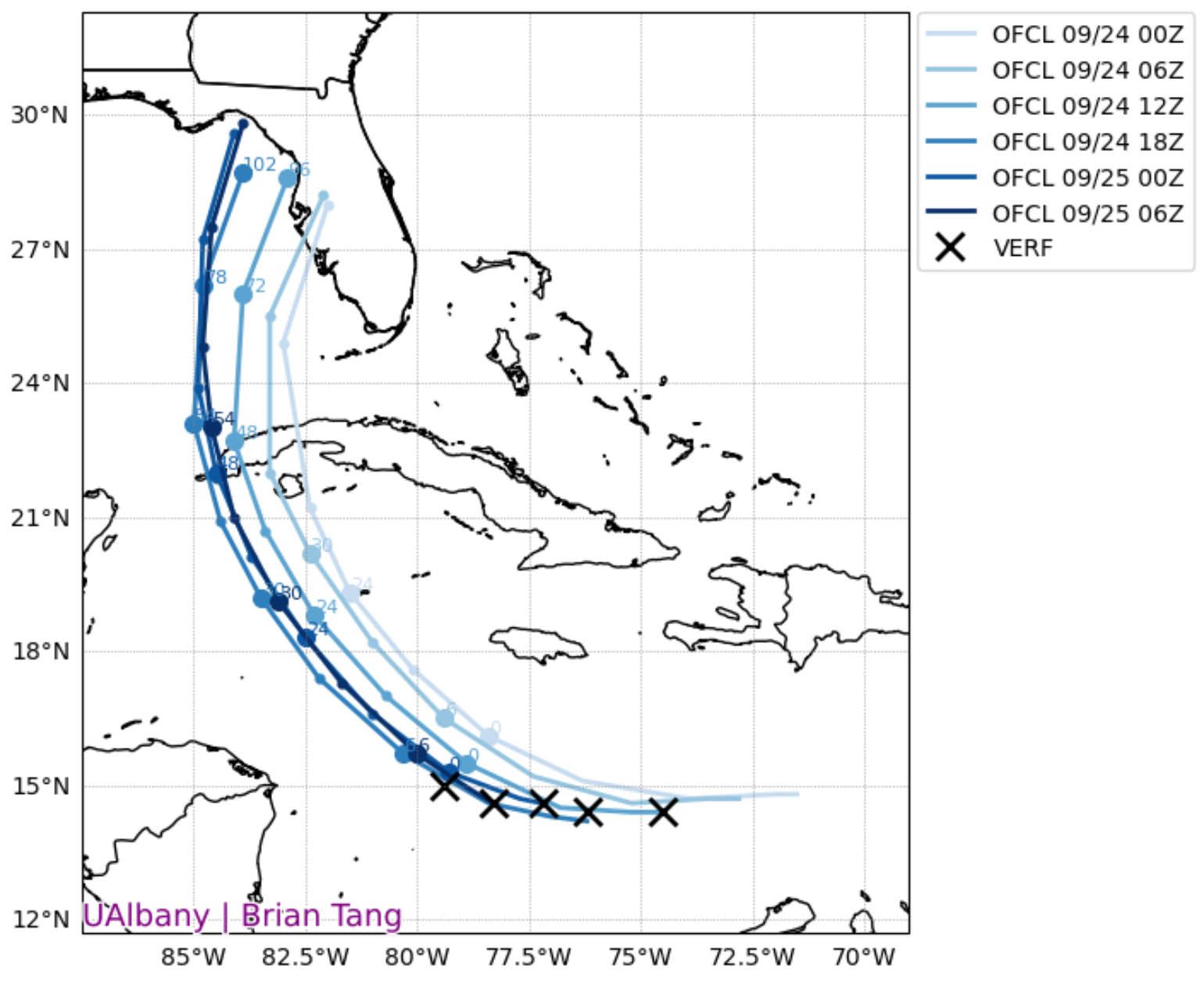

Overall, the NHC OFCL forecast has now started to show some stability with some uncertainty as, again, the five-day track error has about a 200-mile error, and 1/3 of the time named storms can track outside of the cone. The other item to consider with the cone of uncertainty is that impacts can occur way outside the centerline and cone.

Scenario 1: West Coast Florida Landfall

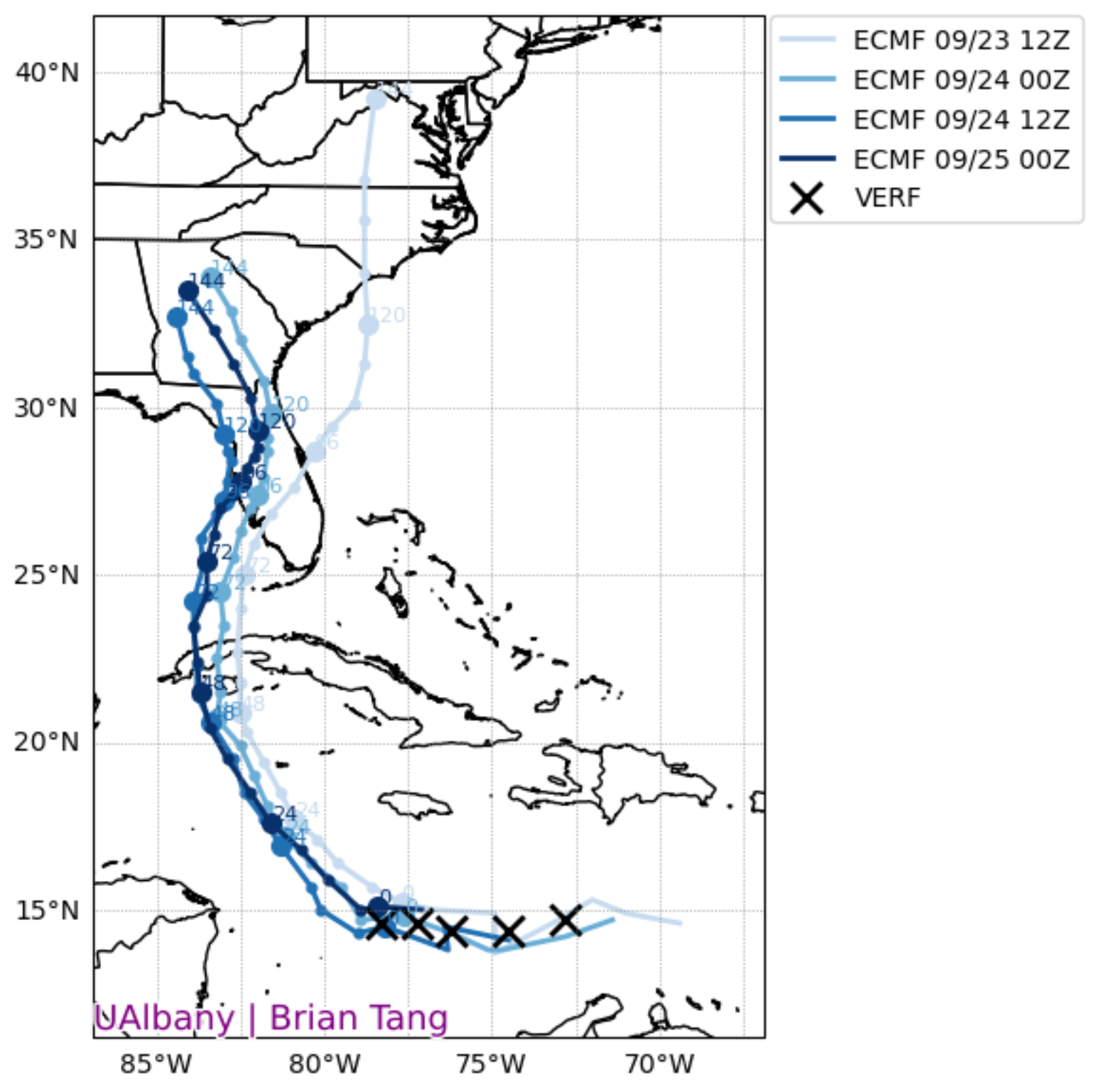

In the short term, if Ian can quickly spin up an inner core and gain strength, it could start in a more northwest direction vs a west-northwest direction. This would have implications on the future track and potential impacts on the west coast of Florida. We have already seen the most eastward scenario of Ian tracking over South Florida come off the table with zero chance of locations like Naples, Marco Island, and Miami seeing any hurricane-force winds. Up the Florida coastline, the probability of hurricane-force wind impacts increases. The ECMWF most seems to be locked into this overall scenario.

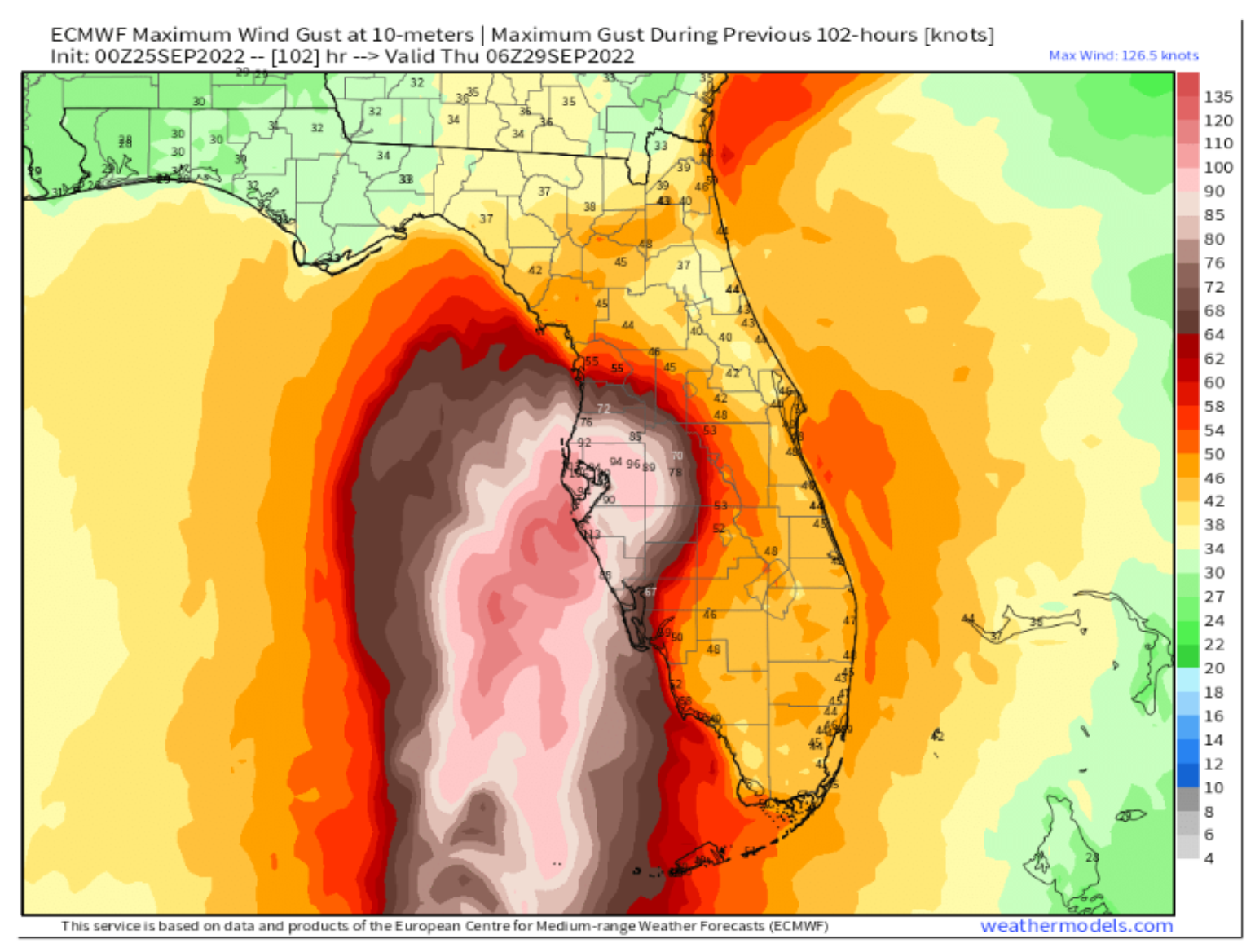

This scenario would, without a doubt, be the most impactful to the insurance industry and be similar, if not worse, than the Tarpan spring 1921 hurricane. That hurricane today would cost the insurance industry between $15 and $25B in the loss. This scenario would also mean the overall impacts would occur sooner on Wednesday into Thursday morning. In this scenario, Ian will also be closest to the warm Gulf of Mexico loop current. It would travel over some of the warmest waters in the Atlantic Ocean and still be in a moist, low-wind shear environment, thereby allowing Ian to be stronger. The ECMWF model at this time has a peak intensity at landfall of 112kts (128 mph), with a central pressure of 957 MB. This would be a solid Category 3 or 4 hurricane at landfall.

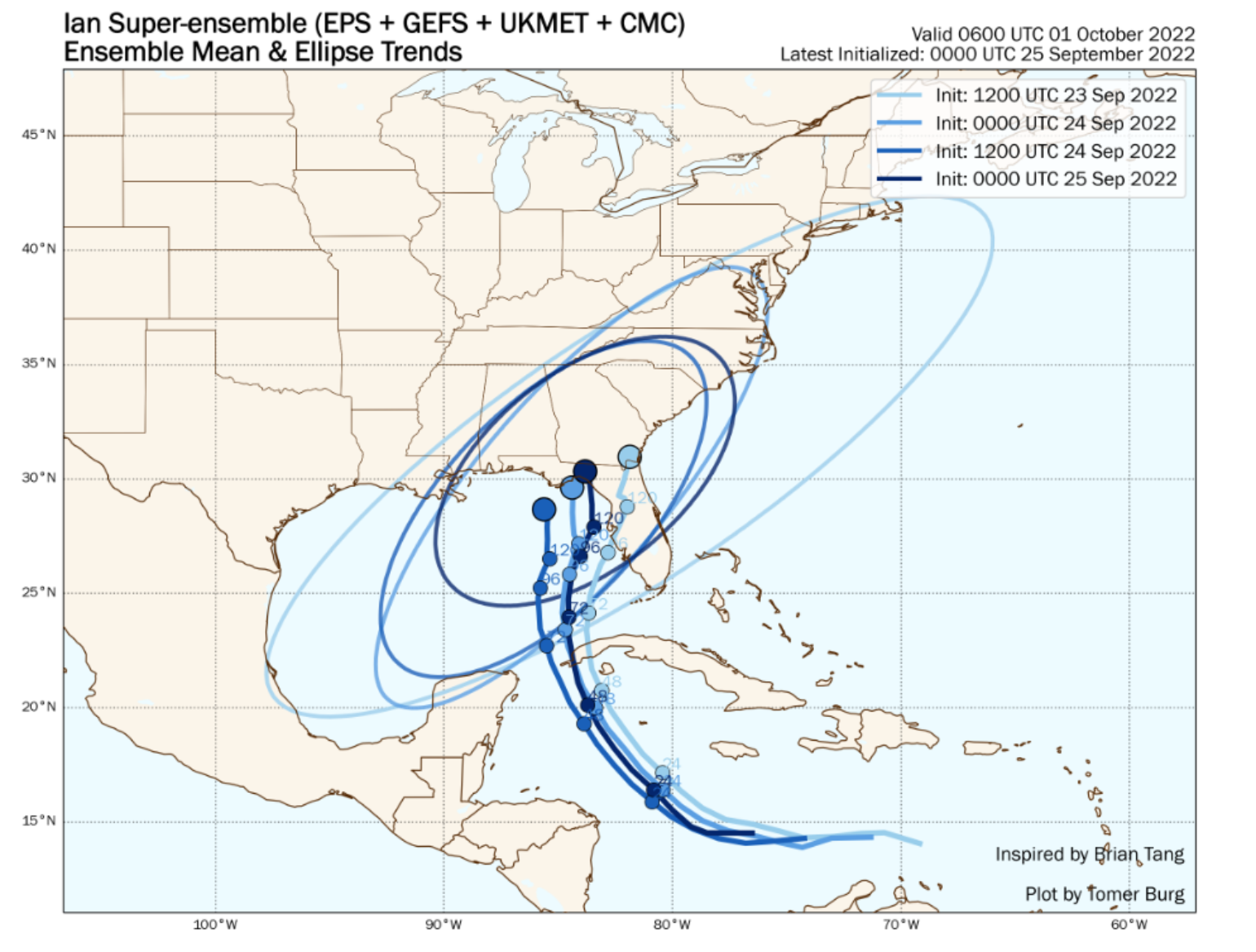

Again, this is just one forecast of the many scenarios that could still verify. The point is that a west coast Florida hurricane will be stronger because Ian will be closer to its maximum intensity. There are still several paths the storm could take within the overall Tomer Burg super ensemble, which represents 121 different forecast scenarios suggesting a possible landfall north of Tampa. As indicated in the tropical update yesterday, landfall location will make all the difference in overall insured loss. This leads to talking about Scenario 2.

Scenario 2 Florida Panhandle / Apalachee Bay Landfall

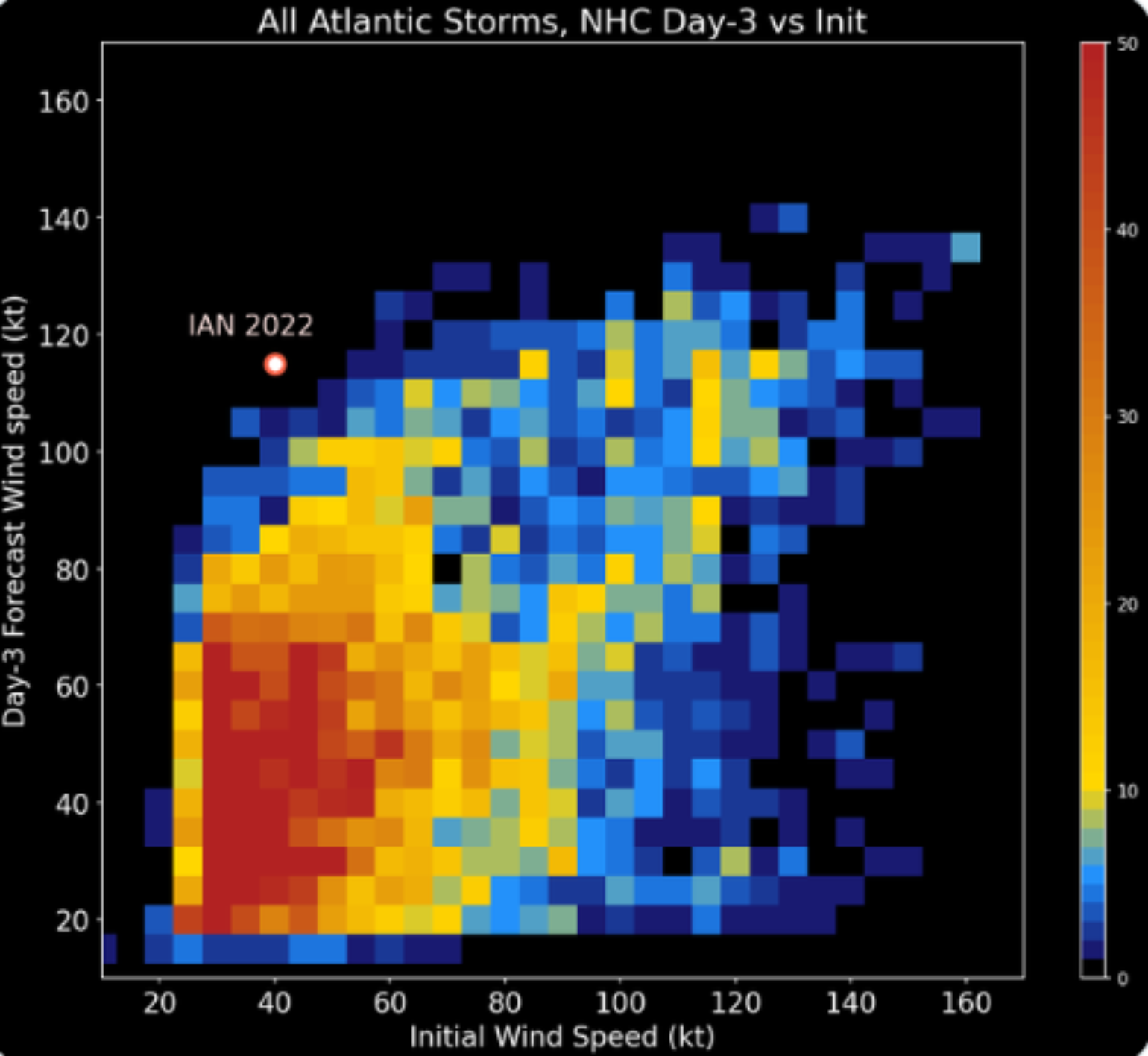

Scenario 2 has the same initial outcome as Scenario 1. Ian will track over warm water and rapidly intensify into a Category 4 storm. While the NHC has Ian’s peak intensity in the Gulf of Mexico forecasted as a Category 4 hurricane, Sam Lillo, a forecaster at DTNweather, shared that going from the current intensity of 45 kts to 120 kts in 72 hours would be unprecedented based on past NHC OFCL 72 hours intensity forecasts.

The significant difference in scenario 2 is heavily dependent on the GFS model solution. It shows that Ian might tracks north toward the Florida Panhandle. As it does this, it gives more time for a deep mid-latitude trough of low pressure to influence Ian in the Northern Gulf of Mexico waters. This would increase wind shear and dry air to weaken Ian before landfall which will not be until Thursday or Friday.

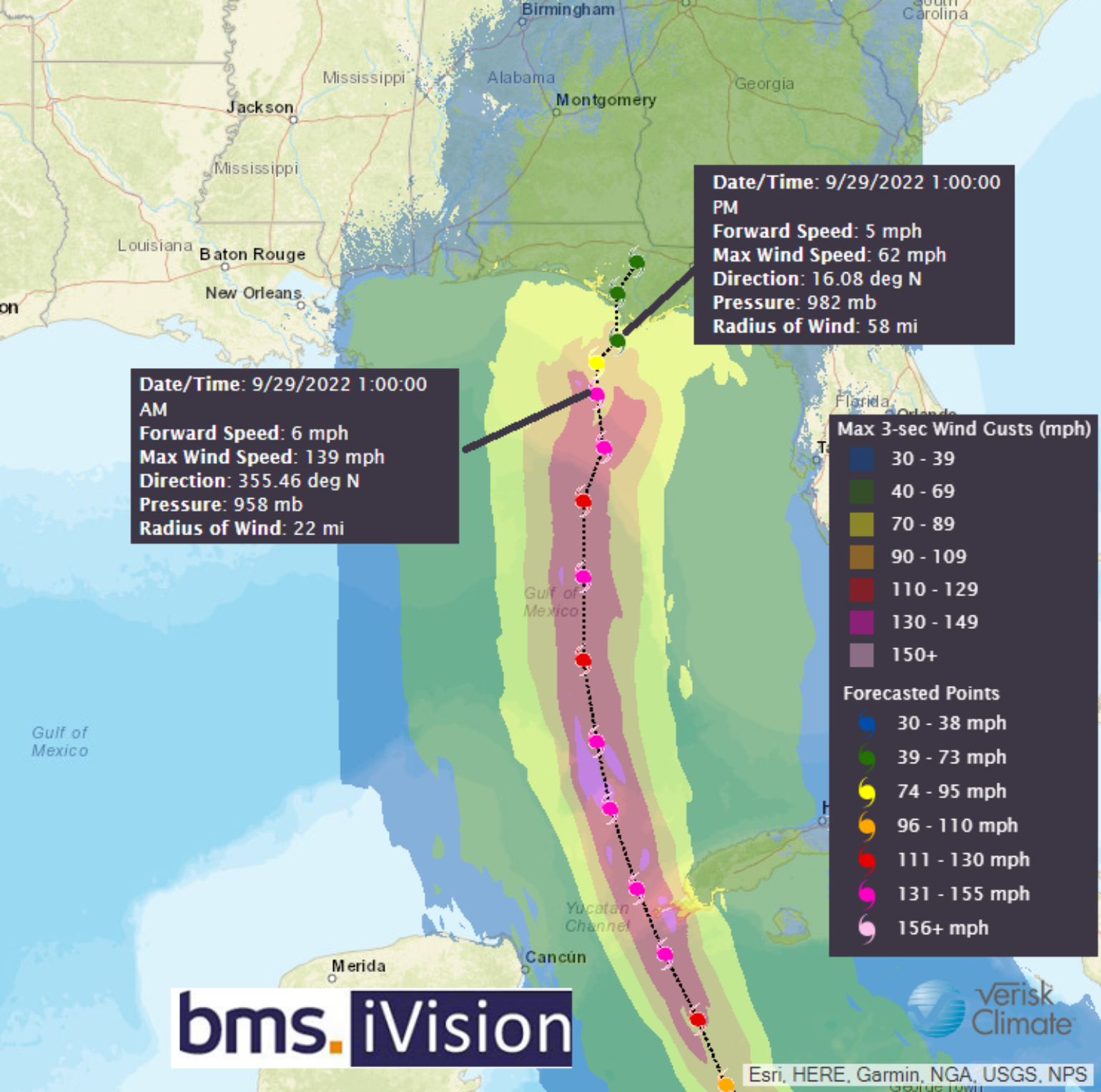

Our BMS iVision wind swath product also follows the GFS scenario, with the maximum wind speed going from 139 mph to 62 mph in a 24-hour period before landfall. This is undoubtedly the best scenario for the insurance industry, resulting in much lower loss over a less populated part of the Florida coastline. As mentioned in past updates, Hurricane Hermine impacted this area in 2016 and only caused $230M in insured loss.

So, what scenario will win out? For Fiona, the ECMWF mean absolute track error was 31 miles more skillful than the GFS model on the five-day forecast. So far, Ian has limited verification data, but the GFS model is performing better at the 24-hour forecast period. Since there is still a bit of forecast uncertainty in these scenarios, it is still best to look at the overall ensemble mean and the trend, which seems to be centered on an Apalachee Bay landfall. However, with this trend shifting back to the east over the last 24 hours.

Bottomline:

- Ian will be a very powerful hurricane in the southern Gulf of Mexico.

- Two possible scenarios heavily depend on how fast Ian can organize in the western Caribbean.

- The scenario to the west coast of Florida will happen quicker and result in a stronger hurricane and landfall.

- The scenario to the north will allow for some weakening before landfall due to dry air and shear possibly influencing the storm structure.

- In both scenarios, we do not know the impact on insurable risk along the east coast, which at this time looks limited in both scenarios.