Sequel In The Making

The highly anticipated sequel to the 1996 disaster classic, “Twister,” is set to hit theaters this summer on July 19th. However, the insurance industry is already reliving the squeal of yet another busy, severe weather season, which has already experienced over $10B of insurance industry loss, with the most recent severe weather events still being tallied. Yet, this loss level should be no surprise to the insurance industry, as severe weather losses usually dominate the U.S. for the first four months. Outside a major earthquake event in a major population center (like last year's Major Earthquakes in Turkey and Syria), severe weather is often the driving cause of high losses for insurance losses in the four months across the U.S. In fact, over the last five years, the first four months of each year have totaled, on average, $14B in severe weather losses, with the previous year seeing a record $21B in the first four months of 2023. This year, there have already been four $1B+ loss events due to severe weather for the insurance industry, while last year, there had been six $1B+ events by the end of April. Given the forecast and a few days left in the month, there is a good chance the insurance industry could round out the months with some significant loss events that put 2024 on par with 2023, so there is no doubt a sequel in the making.

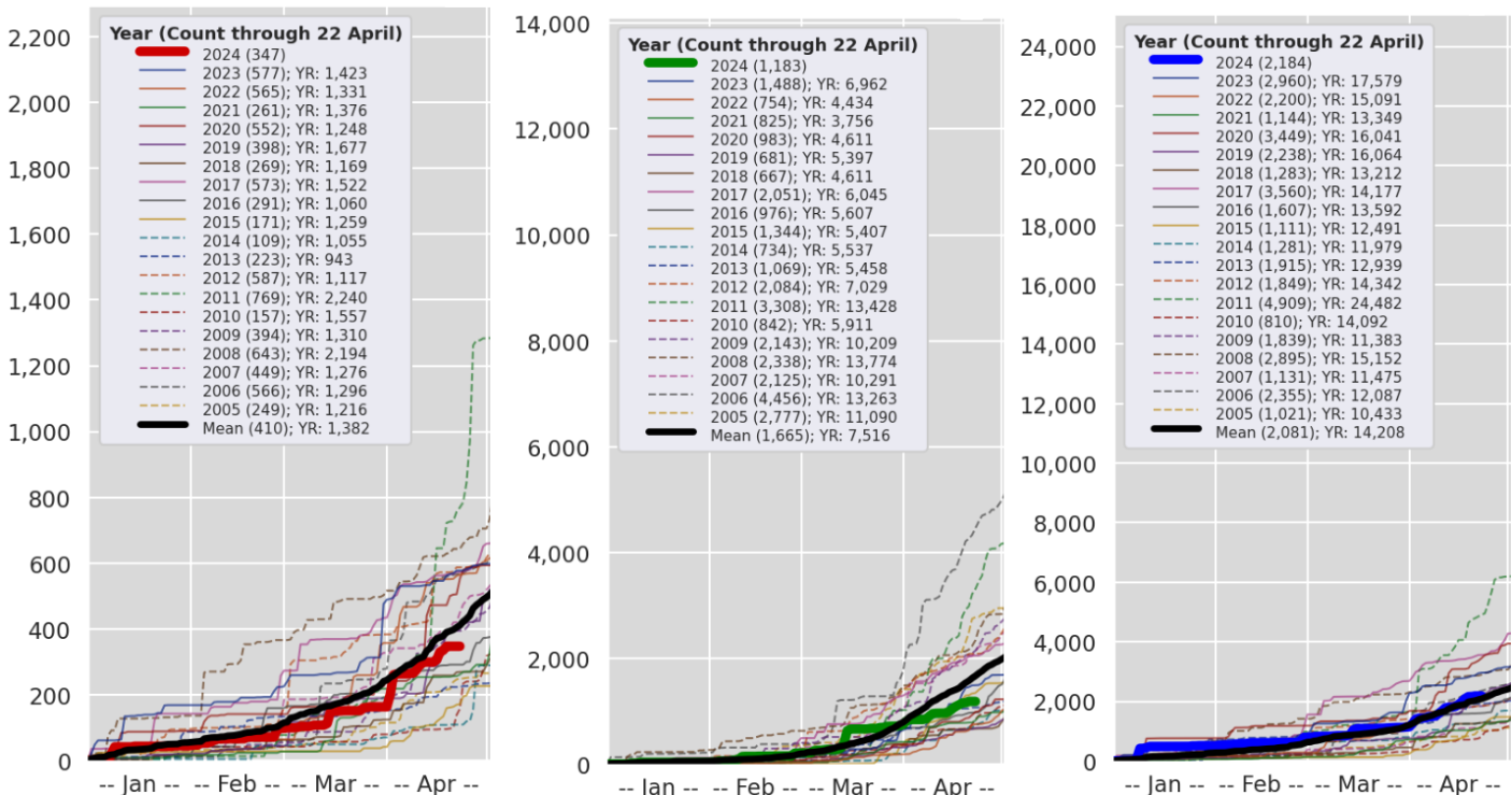

Severe weather losses are heavily influenced by the location of the events, which can be good or bad news for carriers. So far, during this U.S. severe weather season, the insurance industry has seen slightly below-average tornado counts at 347 (410, 2005-2023 Avg). Interestingly, without two major outbreaks of tornadoes that occurred on March 13-15 and April 1-2, accounting for 150 tornadoes over the two outbreaks, the overall count of tornadoes would be well below normal for the season.

Hail counts currently stand at 1,183 (1,665, 2005-2023 Avg). Wind damage reports from thunderstorms are average at 2,184 (2,081, 2005-2023 Avg). This variability in severe weather events underscores the importance of location in determining insurance losses.

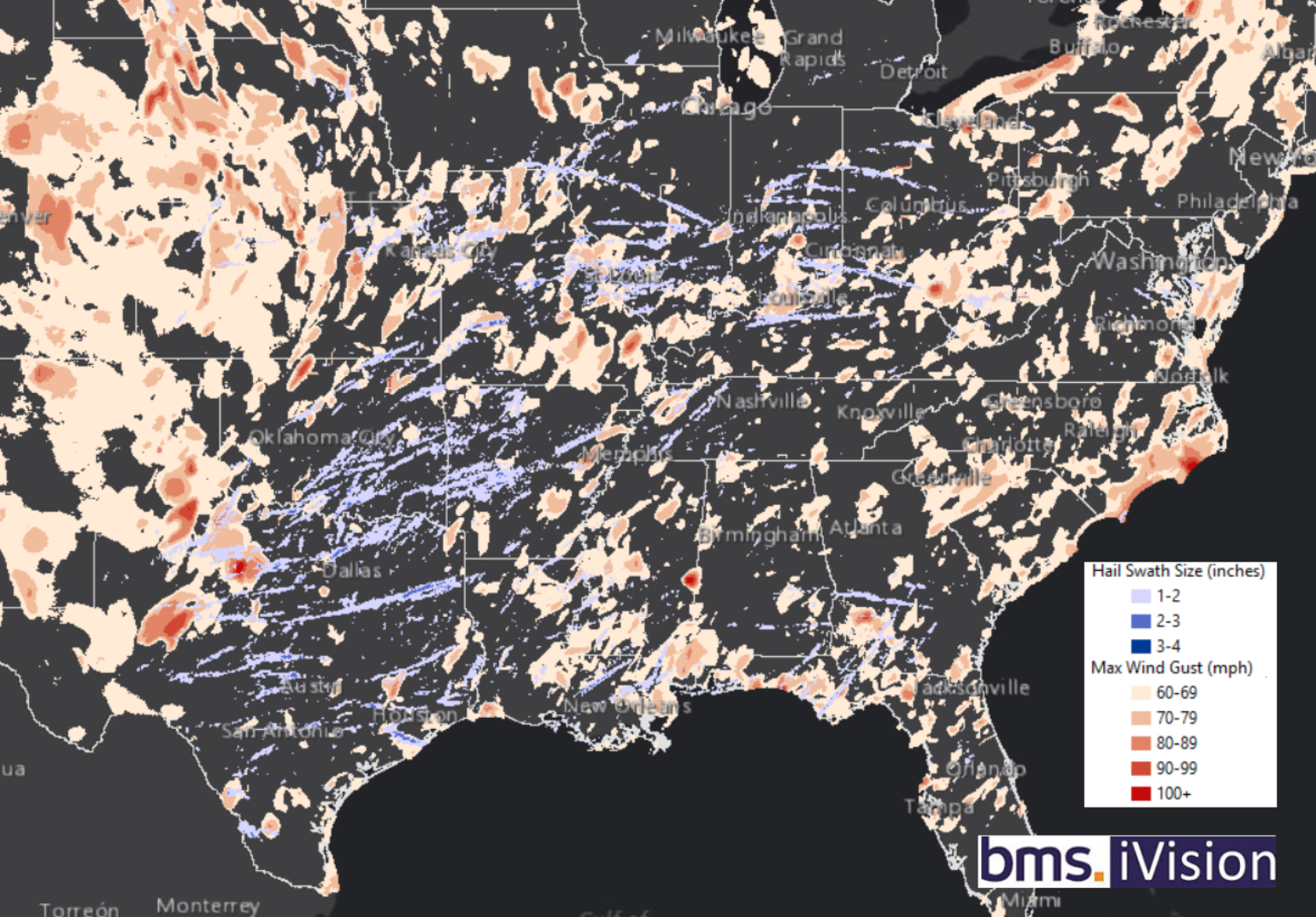

On average, the U.S. experiences around 1,225 tornadoes annually. The season typically ramps up from March through May, with the peak in May, so like clockwork, the insurance industry should expect some big outbreaks over the next few weeks. Again, what matters, though, is where the severe weather occurs. This year, the severe weather hot spots seem focused early within the Midwest, Ohio River Valley, and along the Gulf Coast. Also, remember that hail typically causes 50% - 80% of the overall insured loss from severe weather perils, while the tornado risk drives the longer tail occurrence of loss for the insurance industry.

The image above highlights the maximum 3-second wind gust over 60 mph, combined with the one-inch+ hail swath. These insights are part of our BMS iVision geospatial solution, which uses data from Verisk Respond from 2024 until now. These data layers can help the insurance industry better understand the impacts of severe weather. Our historical inventory of such detailed events, which are cataloged as PCS events specific to BMS clients, goes back to 2012. This tool can also allow insurance carriers to do sensitive testing as their portfolios grow or shrink.

Severe Weather Outlook Next Two Weeks

As mentioned above, the forecast calls for a very active period (April 25 – April 29) of severe weather across the central U.S. This is all due to a series of short waves in the jet stream that will move across the U.S. These waves allow kickers of cold air to slide south and east, which will collide with warm, moist air from the Gulf of Mexico. When combined with the jet stream momentum aloft, this could boost wind shear or cause a change in wind speed and/or direction with height. In turn, these factors could foster spinning storms, allowing for potentially memorable tornadoes to form over more traditional parts of Tornado Alley.

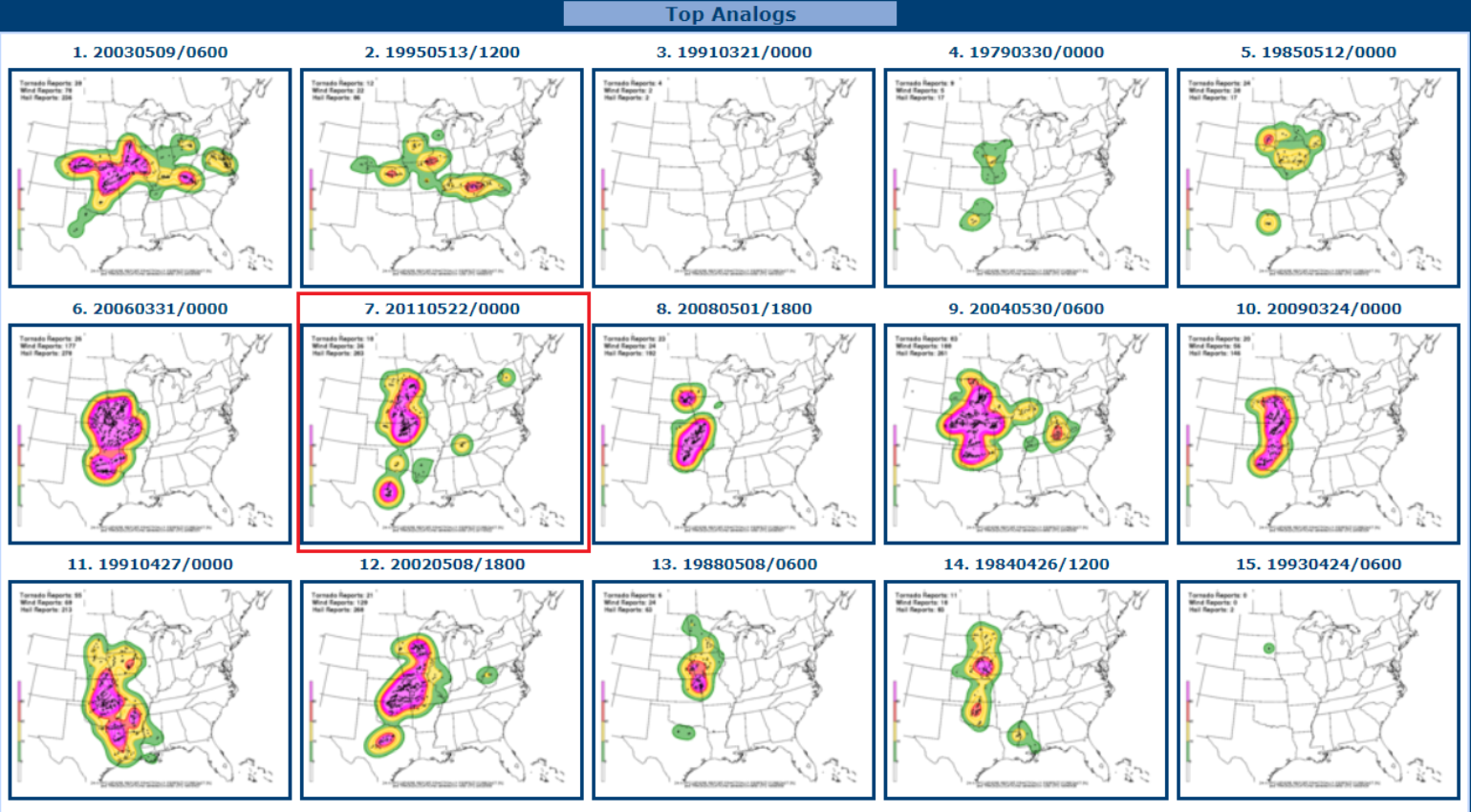

In fact, one way we can determine if the upcoming weather pattern will produce severe weather is to look at the Cooperative Institute for Precipitation Systems (CIPS) historical analog guidance. What this does is look at a particular snapshot in time of the atmosphere and look at analog years that best match that atmospheric snapshot. As a result, 15 top analogs are produced. Of the 15, all but two years selected produce very high levels of severe weather that could form this Thursday and Friday across the Central Plains. One of those analogs might be eye-opening for the insurance industry: May 22, 2011. Yes, that is the date of the Joplin Tornado, which also produced 75 other tornadoes across the central plains.

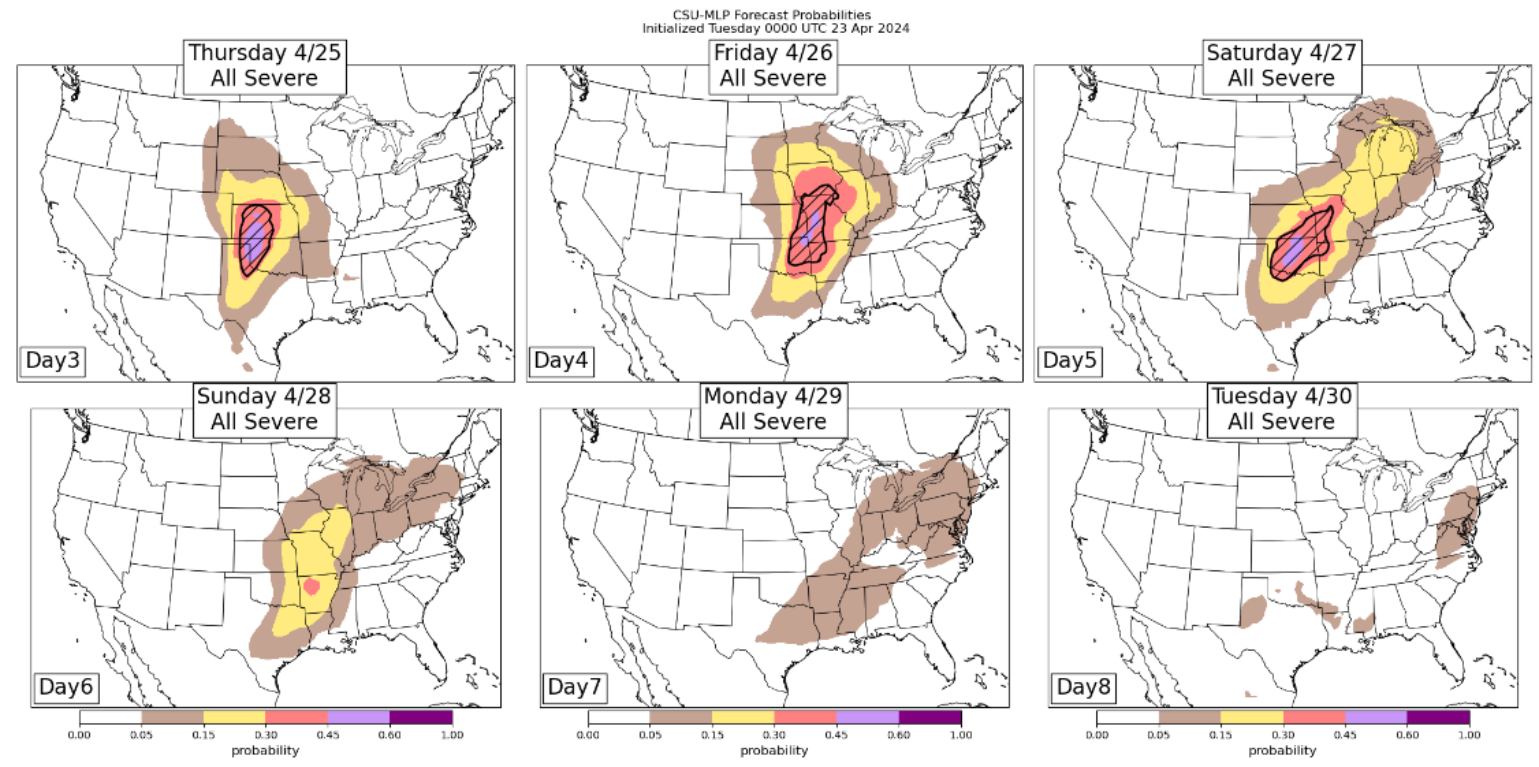

Additionally, Artificial Intelligence (AI) is now being used in severe weather forecasting. Using methods similar to CIPS, the Colorado State University Machine Learning Probabilities prediction product examines various forecasts for the future state of the atmosphere. It matches these predictions with historical observations to determine what might occur regarding the probability of severe weather.

Now, after this recent outbreak, the action might not be finished. The long-range forecast models suggest this active pattern of severe weather could continue into the first two weeks of May. So, as the storm clouds gather and the sequel to Twister looms, Mother Nature is about to unleash a whirlwind of excitement and awe on the insurance industry. Buckle up!