Surprise Wildfire Events Or Not? Lahaina, HI

Surprise insurance loss events happen yearly, very few likely had significant insurance industry wildfire loss events in Hawaii on their 2023 natural catastrophe bingo card. Although these events often shock the insurance industry, these events seem logical after the fact. The Lahaina, Hawaii fire is yet again an example of a known unknown event for the insurance industry. There are very few catastrophe modeling tools to understand wildfire risk in Hawaii, even though the islands have many areas with high wildfire risk. Like many other parts of the western United States, the built environment continues to encroach on these wildfire-risk areas as well.

Unfortunately, the satellite imagery and video footage from air and ground shows another major wildland-urban interface fire disaster has occurred to parts of the city of Lahaina on the Island of Maui, Hawaii. A lot of structure-to-structure spread apparently occurred amid arid and windy conditions, which was enhanced by the passing of Hurricane Dora 700 miles south of Maui, Hawaii. In fact, forecasters from the National Weather Service have been calling for elevated wildfire risk amongst strong winds and expanding drought conditions for over a week. However, let us be clear Hurricanes like Dora do not start wildfires.

Hawaii Wildfire RiskHawaii has always had a wildfire problem. Each year 0.5% of Hawaii’s total land area burns, which is equal to or greater than the proportion burned in any other U.S. State. We do not hear about it because larger mainland fires impacting more significant populations have grabbed the headlines until now. In reality, 99% of all Hawaii wildfires are human-caused! This is even higher than in the lower 48 states. The only natural ignition sources in Hawaii are volcanic events, which are restricted to active eruptions and lightning strikes. However, these are rare because lightning is not as common in Hawaii. When it does occur, it often occurs in wetter microclimates that are wetter, limiting the ignition.Human ignitions coupled with an increasing amount of non-native fuels, fire-prone grasses and shrubs, and extremes in wet and dry climates have greatly increased the wildfire problem over the years. The number of fires per year has ranged from 600 to 1,300 over the last ten years. Peaks in ignition numbers occur around the Fourth of July and New Year’s holidays. Many of the fires start in populated areas, all of which point clearly to people being the leading cause of 99% of all wildfires in Hawaii. At this time, the cause of the Lahaina fire is unknown.

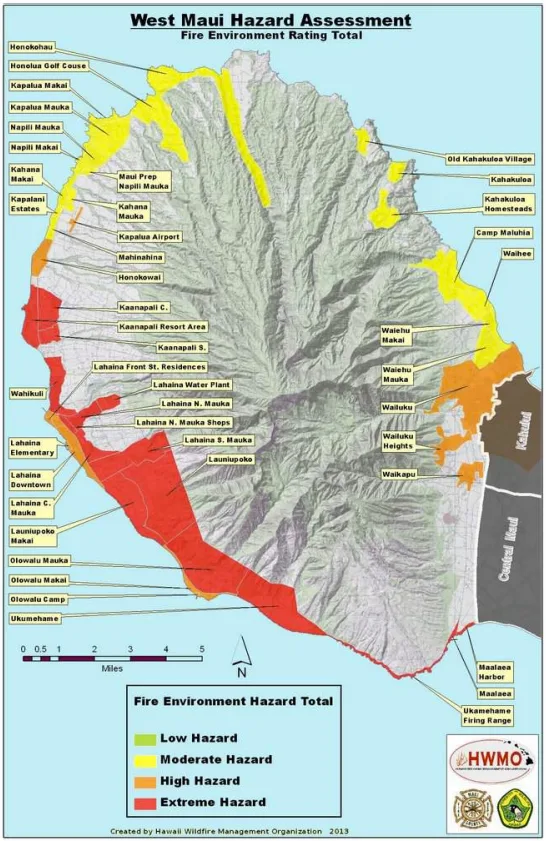

As mentioned, there are limited wildfire hazard analytic offerings for the insurance industry for the state of Hawaii. One such layer that can provide some basic insight is the wildfire hazard potential layer from the U.S. Forest Service and ESRI. Figures 3 and 4 show that areas around Lahaina have a high wildfire hazard, which does not include the ongoing drought-induced conditions in the area. In fact, based on U.S. Landfire.gov datasets, the areas around Lahaina have a mean fire return interval of 11 to 15 years. In addition, the burn area is on the island's leeward side, which is climatologically dry most of the time. The area is also on a down slope, which can be enhanced wind during wind conditions.

Lahaina Insurance Industry ImpactAs mentioned, Hawaii has no major wildfire catastrophe modeling support, so this is essentially a non-modeled risk for the insurance industry. This will likely change now, given this event and its potential magnitude on the state's insurance industry, which often is viewed as a diversification play for some U.S. carriers.

Thus far, 271 structures have been impacted in the town of 13,000 . Some media outlies compare this incident to the Paradise California Camp Fire in 2018, which had a much larger population (26,000) and destroyed 18,000 structures. The one thing that might be different, however, is the building values. Although Zillow is not the definitive source for building values, one can scroll the area and see the property values are easily north of a million dollars for many lots. According to the FEMA National Risk Index for the census tract containing Lahaina along the coastline, the building value totals $847M. Given some simple analysis, this loss could be the highest since Hurricane Iniki in 1992, which in today's dollars, would be $3.3B of insured losses. Other recent events with significant insured losses in the state included the volcanic eruption of Kīlauea in 2018. In today’s dollars, this equates to $338M in losses, and Hurricane Lane, also in 2018, which resulted in losses of $58M.Currently, it is too early to provide an insurance industry loss estimate for the Lahaina wildfire. We have seen a long loss development period from wildfire events as there is uncertainty around replacement cost, loss of use, and business interruption, all of which will come into play. Labor and materials will be tight as well.

Wildfires can happen anywhere under the right conditions. The industry should not be surprised by this if the conditions are ripe. The list of these major wildfire loss events are growing for the insurance industry. Fort McMurray, AB (2016), Gatlinburg, TN (2016). Marshall Fire, CO (2021). Costly wildfires do not have to happen in California, and the risk potential is in many areas, like the Pine Barrens of New Jersey, or the northern forests of Minnesota, Wisconsin, Michigan, and Maine. Wildfires in Hawaii should not be a surprise, and unfortunately, it looks like Lahaina will be a significant loss event for the state to bring awareness to the risk.