What Is The Concern For The Insurance Industry?

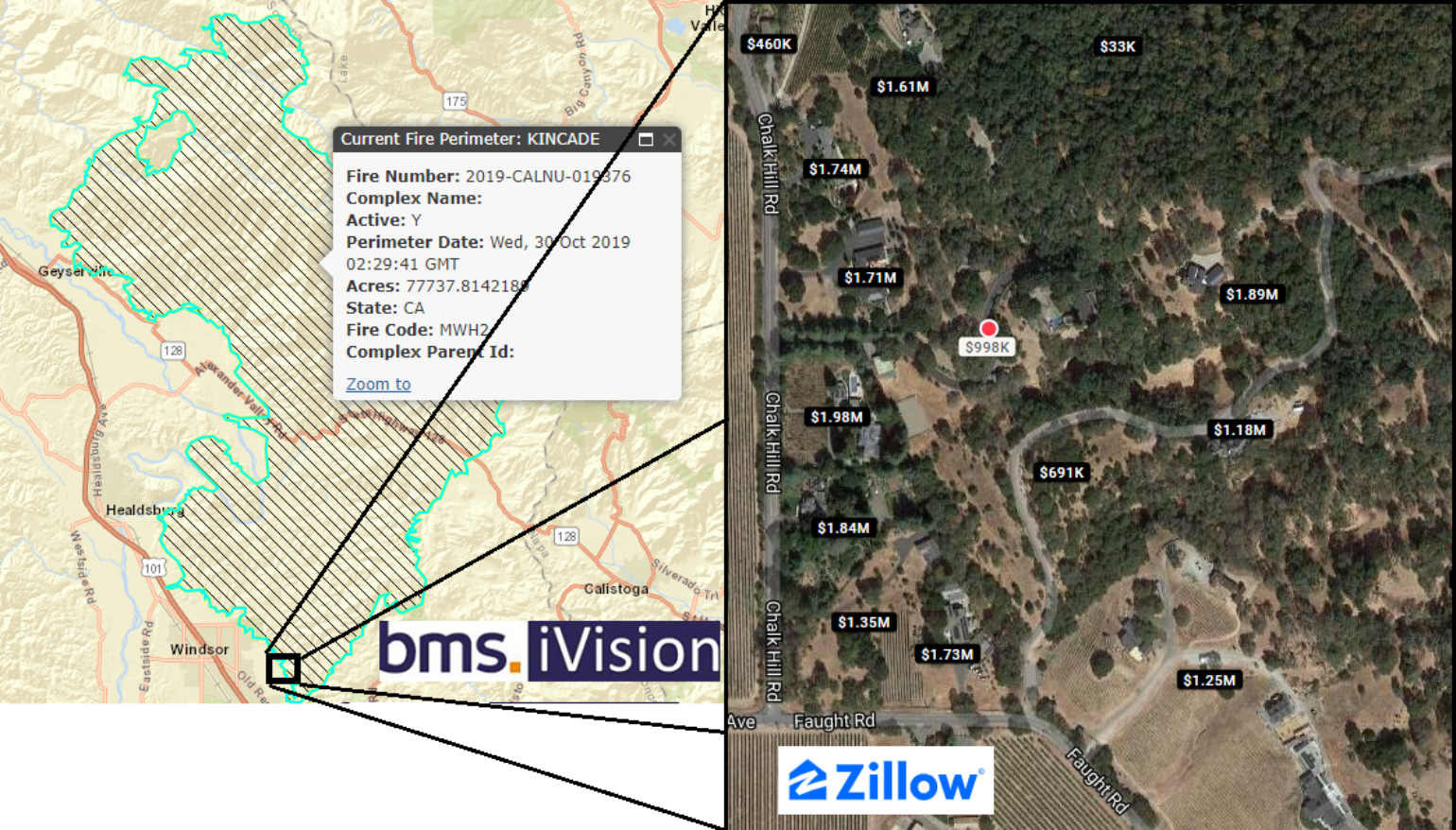

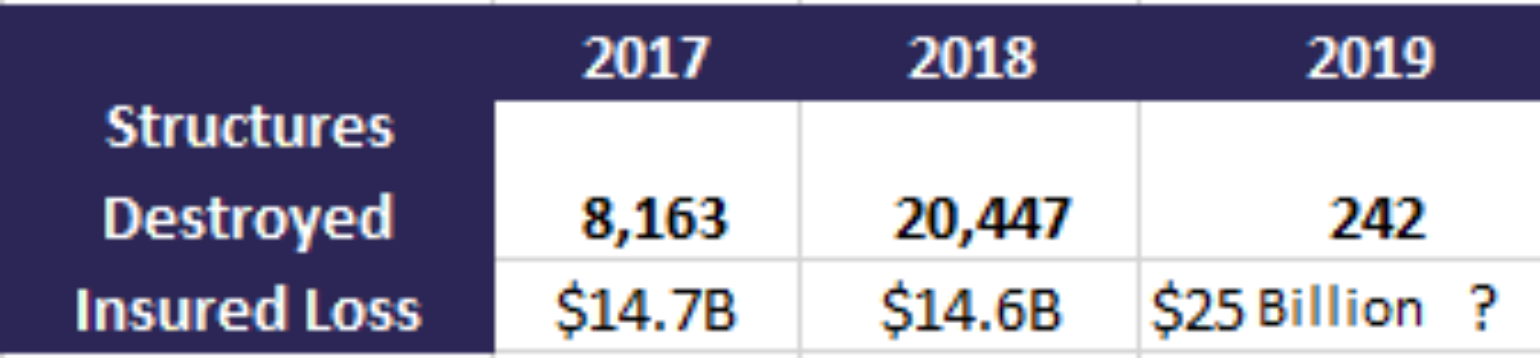

Like clockwork, it’s wildfire season again in California, and it appears to have the insurance industry on edge for good reason. The last two years have been extremely destructive, with insured losses reaching over $30B and, according to Milliman, wiping out about twice the combined underwriting profits for homeowners insurance for the past 26 years. Applications like Zillow make it easy to understand exposures within fire parameters, and some of the properties’ high insured values are likely eye-opening, undoubtedly worrying the insurance industry.

However, I want to first say that, so far, the fires of the last month have caused nowhere near the level of destruction to the industry that was experienced in 2017 and 2018. Headlines like the one below are simply causing unnecessary panic. There is a huge difference between the number of structures exposed versus structures that burn.

In fact, of the current wildfires reported by CAL FIRE, only 242 structures have been destroyed, as compared to the thousands that occurred in 2017 and 2018. I guarantee that this number will climb as the assessment continues. A large fire that wipes out thousands of homes could, of course, still occur this season. But, in my opinion, the industry needs to take a deep breath and trust that the last week has been a buildup to something less extreme at the start of November. Unfortunately, the true end to the fire season is a long time from now, and I don’t see any rain in the forecast for at least the next 10 days. Lastly, we can’t underestimate the amazing work that firefighting crews are doing to try and contain these fires before any more serious damage occurs. For example, the Misty Fire near Oroville, CA was quickly attended to yesterday with air and ground support minutes after it started. These efforts limit insured loss.

New Normal of Forced Power Outages

Although the insured loss level has been relatively low, there are many issues for the insurance industry to consider. The power outages have been massive. In fact, PowerOutage.US confirmed that this is likely the largest forced outage in U.S. history, with close to 3 million people without power at one point. At a time when we are more dependent on electricity than ever – ATMs can’t operate, restaurants are closed and businesses try to limp along on backup generators – there is no doubt that these unprecedented outages are causing huge economic losses. I have seen reports that the economic costs are anywhere from $400M up to $3B, with the caveat that economic losses are complex to understand. Another important aspect of determining insurance loss is that California policies may include a “Loss of Use” provision, which would cover for hotel stays during evacuations. How many insureds are utilizing such coverage is unknown at this time, however. Regardless, this might mean an uptick in such coverage going forward. There is clearly business interruption that could also lead to increased losses.

The power outages could also cause an even greater insured loss because they complicate evacuation. Without lights to find the things they need, along with street lights and stoplights to guide them out of the evacuation zone, evacuees are helplessly gathering their belongings by flashlight and trying to leave via streets that are at a higher risk for accidents due to no traffic lights. One accident can often shutter some of the only exits out of these towns, creating the potential for an even larger loss of life from fast-moving wildfires. First responders are also challenged by the power outages.

Another issue with a lack of power is increased crime. Without video cameras or street lights to hinder criminal activity, the opportunity for insured losses due to crime is escalated. Further, a lack of power can lead to loss if towns can’t pump water. Clearly, this creates problems when trying to fight fires, but it also causes dangerous situations for businesses and residents not having access to water. Evacuation plans and supplies are critical to businesses and residents in locations that have a high earthquake likelihood in addition to wildfire potential.

Is No Trash Pick-Up Next?

Much of the focus has been on the problems endured by utility companies, but other industries are facing huge liability risks as well. A few weeks ago in southern California, a garbage truck caught fire and the driver dumped the burning trash on the side of the road (protocol to do so to save the truck). Minutes later, powerful winds blew the flames across a hillside and into a mobile home community, killing two people and destroying dozens of homes. This is another example of unforeseen risk that may be addressed by limiting trash pick-up during extreme conditions.

Evacuation Fatigue

The vast majority of evacuees will not be affected by the fires and can return to their homes without consequence. Taking a lesson from hurricane evacuation as we mark the seventh anniversary of Hurricane Sandy 2012, however, is that evacuation fatigue is real. During Sandy, many people didn’t leave because, in the prior year during Hurricane Irene 2011, calls for evacuation were ordered, but the storm weakened with limited impact to the Northeast. Some of the evacuees chose not to leave the next year only to find them themselves suffering from the impact of Sandy. I am sure evacuation fatigue is already setting in for many California residents, and unfortunately, this could cause more problems in the future as people wait longer to leave, causing major traffic jams. The fallout could be deadly.

Season Is Not Done Yet

In summary, even though it currently appears that the insured loss will be limited, the overall risk will remain high until, hopefully, a weather system around the middle of November will bring some much-needed precipitation to the west coast of the U.S. The early December fires of 2017 that totaled over $2.5B in insured losses serve as a reminder that the California wildfire season is not yet close to being done. With any luck, however, the recent events will have been the peak of the season’s activity. The insurance industry and California residents are on edge, and the forced power outages could get worse – even with massive outages, two of the major fires were caused by utility lines that were not de-energized. These outages are having large economic impacts and, to some degree, will be felt by the insurance industry going forward. On a positive note, however, they could also provide an opportunity for the development of new products to help mitigate the loss of power without physical loss to a structure.