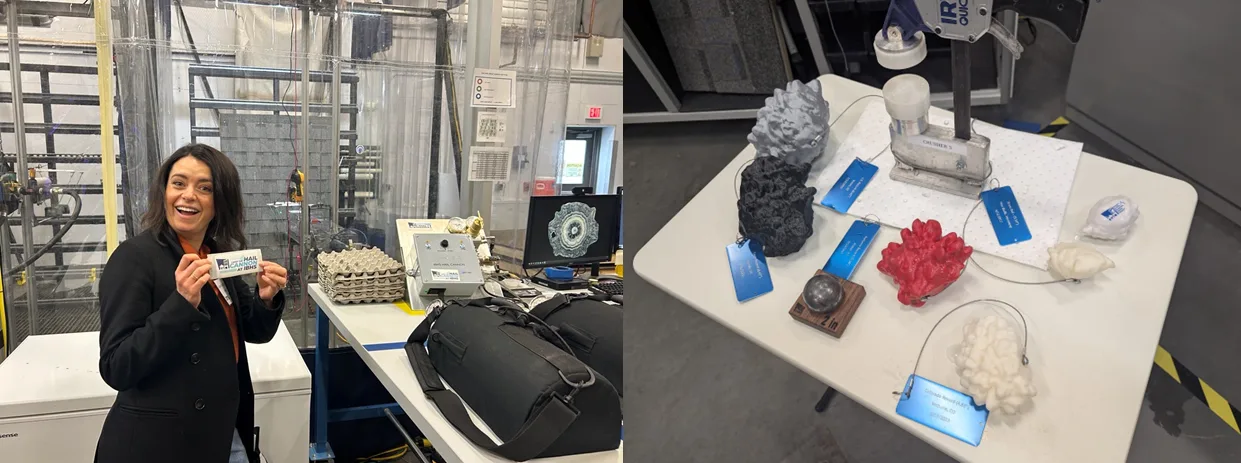

This week, 22 individuals representing BMS clients, their trading partners in the reinsurance markets, and some brokers had a unique and eye-opening experience at the Insurance Institute for Business & Home Safety (IBHS).

As a reinsurance broker, BMS is a long-standing member of the IBHS. To provide comprehensive solutions to our clients worldwide, we often analyze risks and help clients manage exposure to natural disasters. A good example of this might be our BMS Bacchus program, who were also in attendance. But, there is no substitute for seeing firsthand how homes and businesses withstand - or fail to withstand - the forces of hail, wind and wildfire. The concept of the BMS–IBHS showcase was not just to listen to research findings, but to engage with them in a way that made the data real. Watching simulations of simple tests about batter structure design or up close hail impact testing and exploring the recent field research around early lessons learned from LA wildfires with wildfire-resistant construction. All this leads to the key takeaway that we can - and must - build resilience into our homes and businesses, regardless of what a future climate might hold.

A Kitchen Remodel vs. A Roof Replacement: Understanding What Protects Your HomeOne of the most striking insights from our discussions at IBHS was the disparity in how homeowners approach home improvement, either before or after a disaster.

Investing in high-quality roofing materials, such as sealed roof decking and impact-resistant shingles, provides a strong return on investment (ROI) by significantly reducing potential losses from extreme weather events. At the IBHS, one of the important lessons we learned was about a sealed roof deck. For example, preventing water intrusion even if shingles are blown off during a storm, minimizing costly interior damage from leaks and mold. Keep in mind that this often costs only $500 to $2,000 more than a roofing project, depending on the labor cost and complexity of the roof. However, the upfront cost here can lower insurance claims by thousands of dollars per home, translating into lower premiums and long-term savings for homeowners. For insurers and reinsurers, the widespread adoption of resilient roofing reduces large-scale losses, stabilizes risk pools, and helps maintain affordable coverage in high-risk areas. Spending a bit more on a durable roof upfront can prevent exponentially more significant repair costs, making it a financially sound decision for homeowners and the insurance industry.

However, there is a fundamental problem. Generally, when someone is remodeling a kitchen, they’ll spend months obsessing over every detail - the brand of appliances, the type of countertops, and the latest smart-home integrations. They’ll read reviews, visit showrooms, and compare features to ensure they get exactly what they want. When the remodel is done, they might even showcase it and describe every detail to their neighbors and friends.

But, when it comes to replacing a roof, the level of scrutiny often drops dramatically. Many homeowners take the contractor’s recommendation or go for the lowest bid without understanding their choices of materials, durability or long-term resilience. Maybe this will change now that changes in policy terms, conditions and coverages are putting more weight on the homeowner to care, as in general, the homeowner should care because the roof isn’t just another component of a home - it’s the first line of defense against storms, hail and wildfires.

A kitchen remodel adds comfort and aesthetics, but a resilient roof can mean the difference between minor damage and catastrophic loss during a severe weather event that might just protect that new kitchen. Yet, homeowners are often unaware of the significant improvements they can make to protect their homes, such as impact-resistant shingles, sealed roof decks or ember-resistant vents.

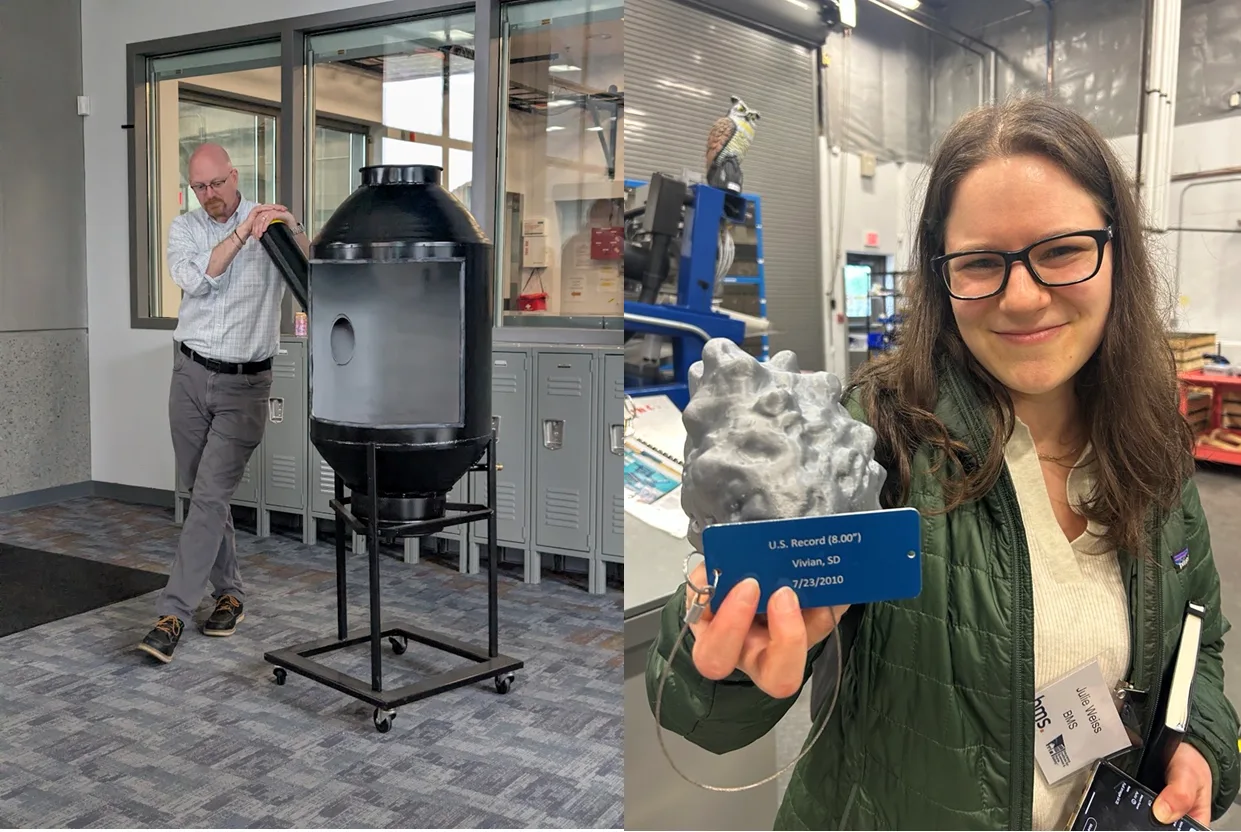

The Science Behind Resilient Building PracticesAt IBHS, we delved into the rigorous research behind these protective measures. We saw the impact of large hailstones - engineered to mimic real-world conditions - pummeling different types of roofing materials. We examined how high winds penetrate weak spots in poorly built homes, leading to devastating failures. We also explored how small design choices, such as using Class A fire-rated roofing materials or installing metal screens over attic vents, can dramatically improve a home's ability to withstand wildfires.

IBHS doesn’t just test materials in a vacuum; it recreates real-life conditions to understand what works and what doesn’t. For example, its FORTIFIED Home and Business programs provide clear, research-backed guidance on how homeowners can upgrade their roofs and other structural components to withstand extreme weather. Insurers and reinsurers increasingly recognize these measures as cost-effective ways to reduce claims and protect communities.

Why This Matters for the Insurance IndustryFor those of us in the reinsurance sector, the implications of IBHS research are clear. Strengthening homes isn’t just about reducing individual losses, it’s about improving the resilience of entire communities. When homes are built or retrofitted to withstand hail, wind and wildfire, it reduces the financial burden on insurance carriers, reinsurers and, ultimately, policyholders.

We also need to educate homeowners. As the real estate industry has trained consumers to value high-end kitchens and luxury finishes, we must shift the conversation to the importance of durable, well-engineered roofs, impact-resistant windows and innovative building techniques. This requires collaboration between insurers, brokers, builders and policymakers to incentivize resilience and ensure that homebuyers understand what truly makes a house safe. Which is why the showcase brought together carriers, brokers and reinsurance markets to help with this education.

Moving Forward: What Insurance Carriers Can DoInsurance carriers are critical in driving resilience by influencing homeowner decisions and shaping industry standards. Here are a few key steps carriers can take to promote stronger, more disaster-resistant homes:

Incentivize Resilient Building Practices:

Offer premium discounts, policy endorsements or deductible reductions for homes that meet better standards like the

, have sealed roof decking, or incorporate impact-resistant materials. Financial incentives can encourage homeowners to invest in resilience.

Enhance Policyholder Education:

The BMS - IBHS showcase was all about education, but it shouldn’t stop with our one-day event. There needs to be more outreach programs to inform homeowners about the benefits of durable roofing, fire-resistant construction, etc. Just as homeowners research high-end kitchens, they should be equipped with knowledge about materials that truly protect their homes.

Support Stronger Building Codes:

The insurance industry is skilled at working with policymakers on various topics. The industry should emphasize advocacy for updated construction standards that incorporate research-backed mitigation techniques, which will reduce losses in the long run.

Collaborate with Contractors and Builders:

Carriers are being pushed to select who does the repair work, which might help homeowners select builders and roofing companies that promote the use of resilient materials. This also ensures that policyholders will have access to qualified professionals who understand how to install the mitigation efforts properly.

Encourage Post-Event Resilient Rebuilding:

After disasters, insurers should actively promote rebuilding efforts that go beyond basic repairs, encouraging homeowners to upgrade to wind- and impact-resistant materials rather than simply restoring pre-existing conditions. Of course, this goes along with item one on this list.

By taking a proactive approach, insurance carriers can reduce future claims, create safer communities, improve policyholder satisfaction and help stabilize an increasingly volatile market. Resilience isn’t just about recovery - it’s about preparing for the next event before it happens.

ConclusionOur time at IBHS reinforced a fundamental truth: Resilience isn’t just a buzzword - it’s a necessity. As the insurance and reinsurance industries grapple with increasing catastrophe losses, we must shift our focus from simply paying for damage to actively preventing it. By prioritizing resilient construction, educating consumers and leveraging cutting-edge research, we can help ensure that homes aren’t just places of comfort but bastions of safety in the face of nature’s fiercest challenges.If you’re a home or business owner, we at BMS, along with our partnership with IBHS, encourage you to examine what protects your home or business more closely. And if you’re in the insurance industry, let’s work together to make resilience the standard, not the exception.

Gallary Of Other Images From Our BMS - IBHS Showcase