Was the 2019 Hurricane Season Active or Not?

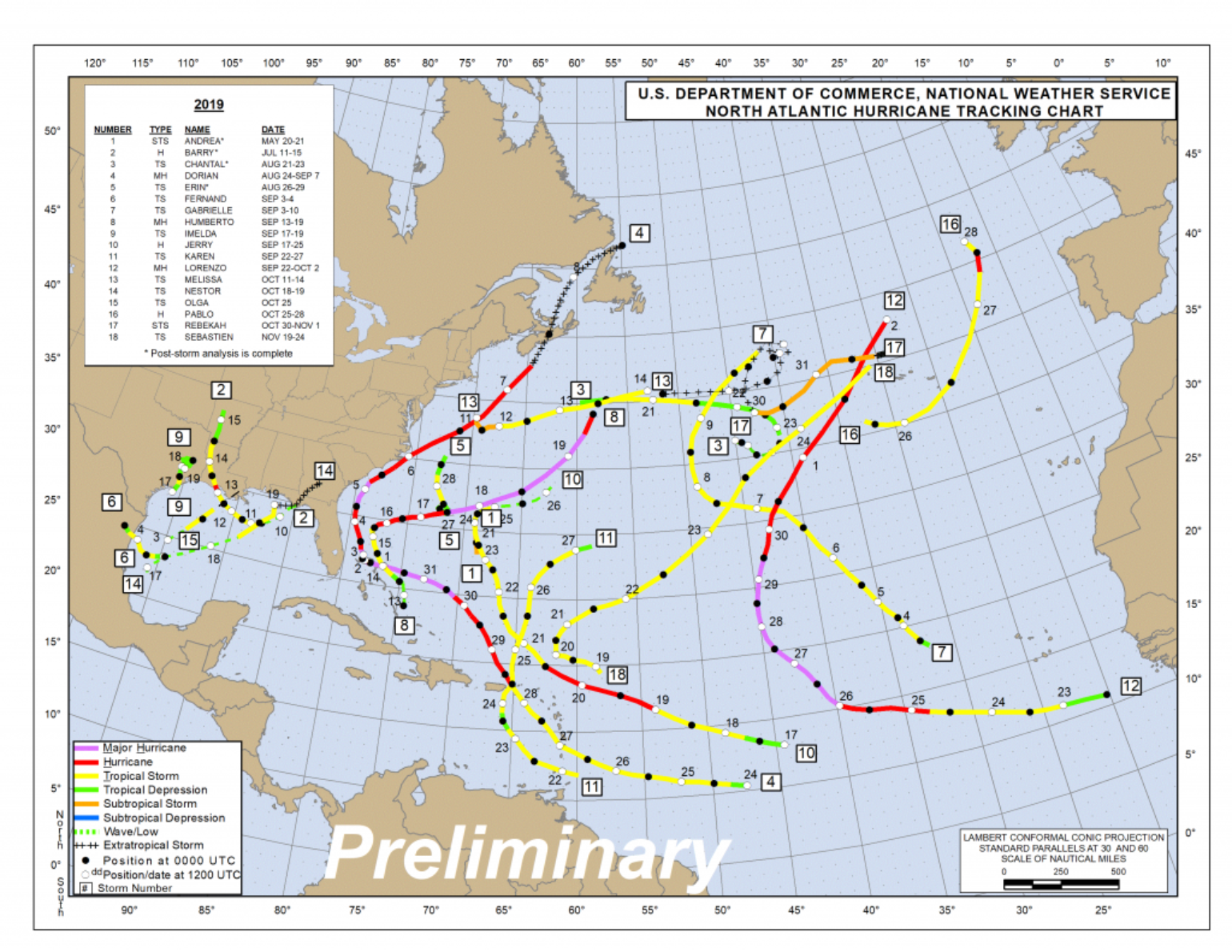

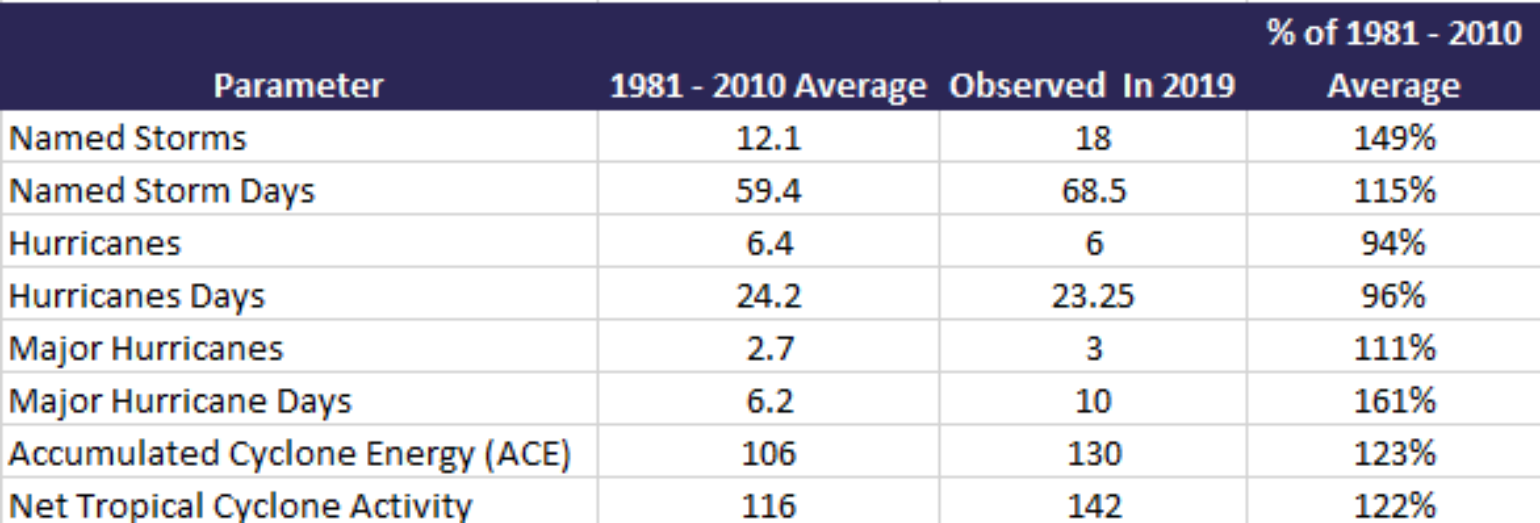

The six-month 2019 North American hurricane season is officially in the books and it was an active one in terms of named storm counts, with the majority of activity coming in the typical mid-August and mid-October periods. The season ended with 18 named storms, six of which became hurricanes, and three of those achieving major hurricane status (Category 3+ on the Saffir-Simpson scale). Having 18 named storms in a season is well above the 12.1 average (1981 – 2010), but the number of hurricanes and major hurricanes are right around what would be expected in an average year. In terms of ACE (Accumulated Cyclone Energy), the season ended up at 123% of the average, with two storms, Dorian and Lorenzo, contributing an impressive 61% to the tally.

What is, perhaps, even more interesting is that, of the 18 named storms, eight of them lasted two days or less and some didn’t even last 24 hours. Two storms (Olga and Imelda) ended up being named storms for only six hours. The number of named storm days totaled 68.5, which is 115% of the expected 59.5 average (1981 – 2010). This year clearly showed the bias to satellite observations, as several of the named storms this year likely would not have been named in the pre-satellite era.

Even these short named storms can be destructive to the insurance industry, such as Imelda, which impacted parts of eastern Texas with 43 inches of rainfall. This highlights that the category is not always indicative of how destructive a hurricane might be. In fact, the named tropical storms of Imelda, Nestor, and Olga accounted for 42% of the total U.S. insurance industry loss this season, which should likely ultimately settle for under $2 billion. However, it should be noted that the named storm average annual loss for the U.S. is over $15 billion annually, so the U.S. insurance industry was lucky this year, especially considering Dorian.

The season will clearly be remembered for major hurricane Dorian, which stalled over the northern Bahamas as a Category 5 hurricane for nearly two days and gave south Florida a good scare when the monster storm refused to leave the area. The insured loss impacts to the Bahamas are expected to surpass $3.5 billion (USD). Despite the strongest winds remaining off the coast of the U.S., impacts were still felt in Florida, Georgia, South Carolina and North Carolina (but not Alabama). This will be the largest insured loss event for the U.S. this season at over $500 million.

We also can’t forget about Dorian’s impact to eastern Canada, which is expected to hit around $2 billion (CAD) of loss and had a wide-ranging impact. This is a good reminder that strong named storms can easily impact New England during a hurricane season. With saturated ground and trees being in full leaf, many large trees were uprooted across eastern Canada, leading to long-term power outages, a major source of loss after strong wind events. Around 80% of the homes and businesses lost power in Nova Scotia at one point which is a reminder that the insurance industry can easily suffer losses from long term business interruption payments.

How Lucky

I’m not sure if the worldwide insurance industry truly understands the bullet that was dodged this hurricane season, as we saw the most intense hurricane to ever impact the Bahamas, which also tied the record with the 1935 Labor Day hurricane for the strongest landfall anywhere in the Atlantic. Clearly this would have been an industry-changing capital event if Dorian had stalled over Palm Beach or Miami-Dade counties with 185 mph winds and 40+ inches of rain. The losses could have easily reached $75 billion of insured loss and maybe more. The winds alone would have caused considerable damage to almost every single insured property in southeast Florida. The storm surge and flooding rains would have likely had a major impact on the National Flood Insurance Program and many of the new private markets now writing flood business in Florida. Even with 11 consecutive years (2006 – 2016) of no major hurricane catastrophes in Florida, there have been other loss issues across the state that have already strained parts of the market. Such a catastrophic event at this time would have been a big stress test for the Florida Hurricane Catastrophe Fund, considering such a Dorian-type event would be near the 100-year to 250-year event that many companies plan for on a yearly basis.

The other noteworthy (positive) impacts on the insurance industry might be the huge void of hurricane activity in the Caribbean Sea and Gulf of Mexico. In fact, only hurricanes Dorian and Barry reached hurricane-strength in those areas, which again is welcome news for the insurance industry. It always amazes me when a named storm can impact the tiny insurance hub of Bermuda, which happened this year with Hurricane Humberto.

A look ahead to 2020:

I admit that it’s way too early to make predictions for the 2020 Atlantic hurricane season, but some of the climate forcers to think about for 2020 are listed below.

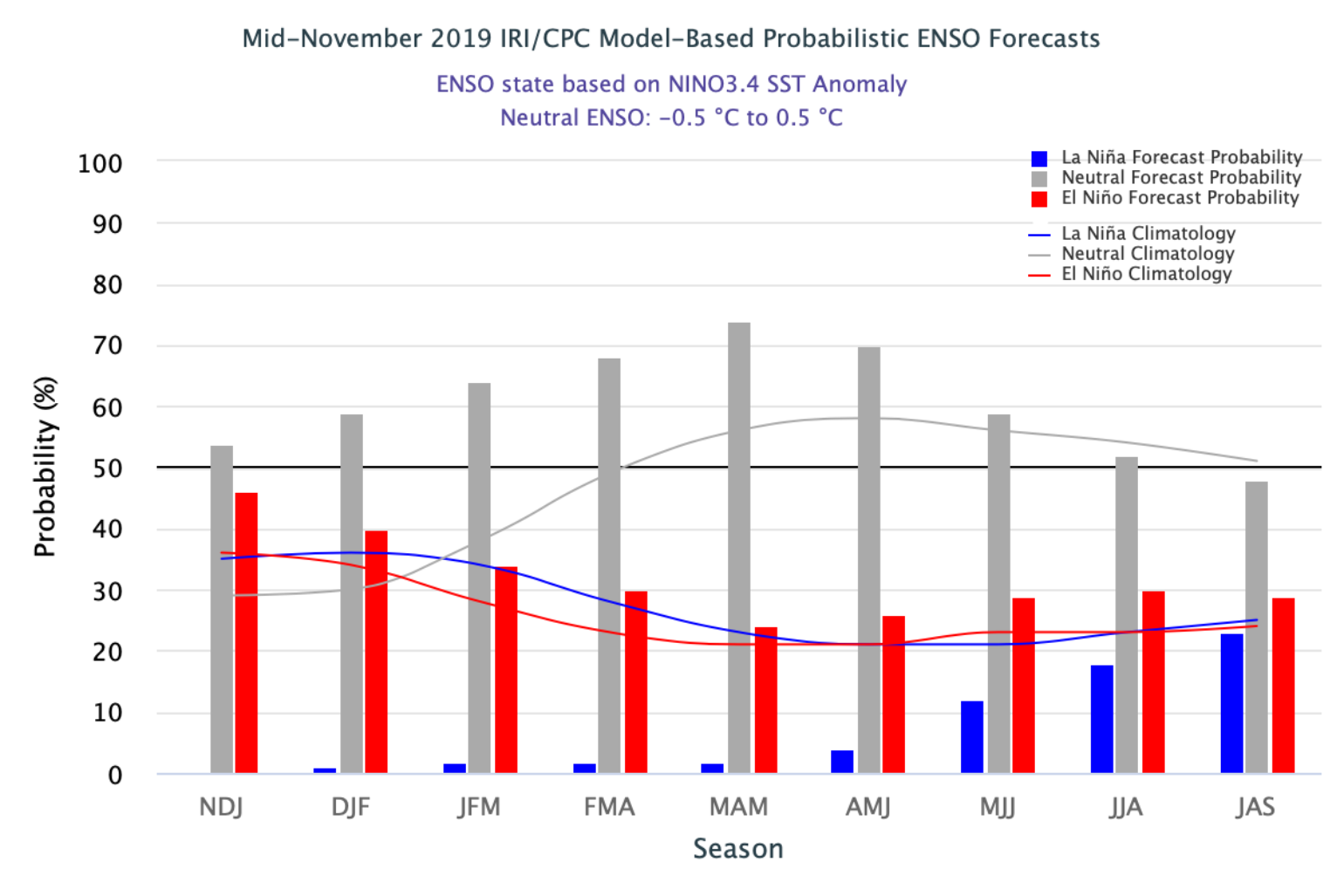

- El Niño Southern Oscillation (ENSO) is currently in a neutral state and is forecasted to stay there for the beginning of the 2020 Atlantic Hurricane Season. If this is the case, neither La Niña or El Niño will have a large influence on wind shear or storm tracks.

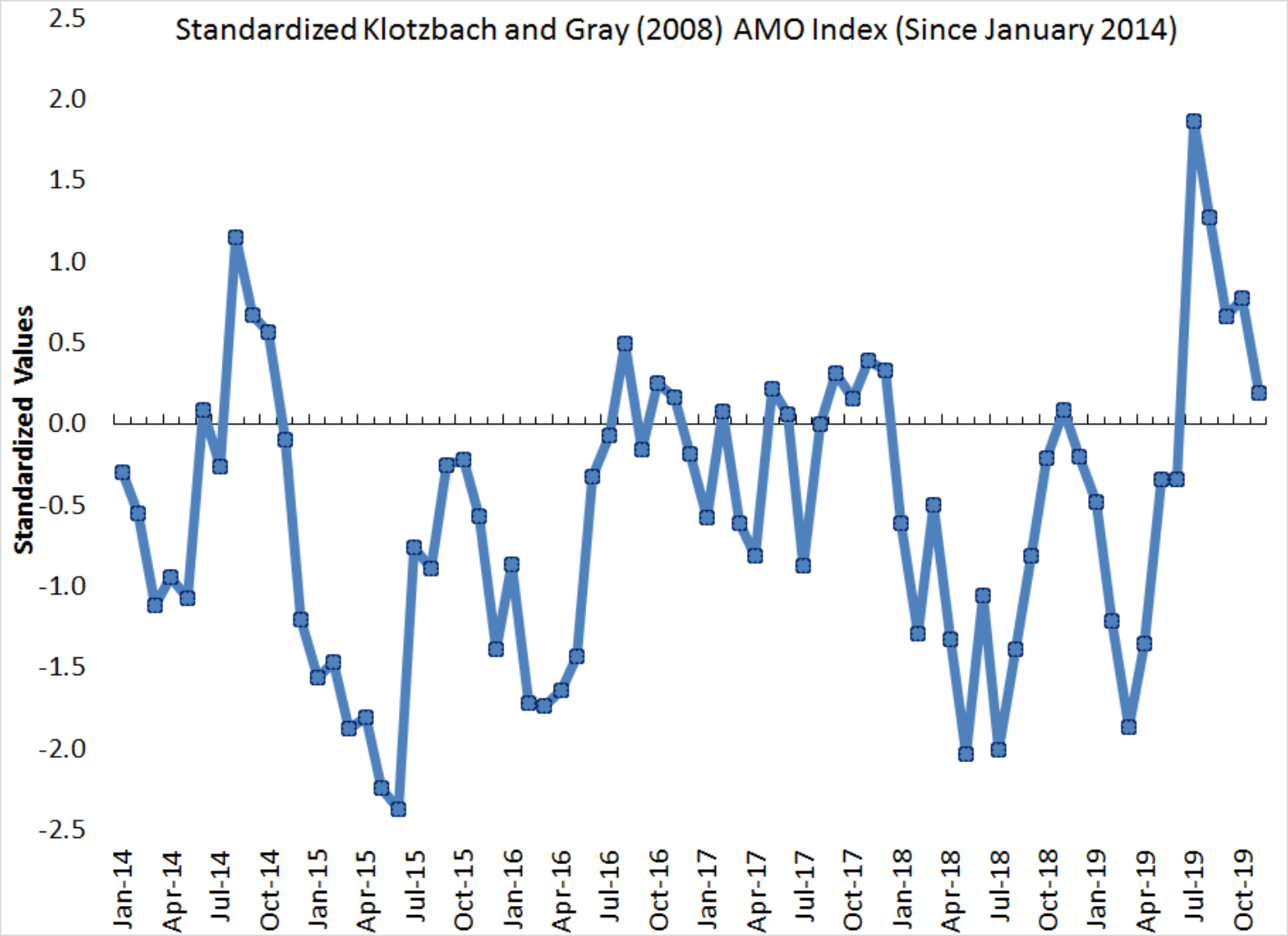

- After spiking this summer, the Atlantic Multidecadal Oscillation (AMO) index dipped back to near average in November according to the Klotzbach and Gray AMO index, as far north Atlantic sea surface temperatures are currently near their long-term average values. This could have explained the higher activity this season and could lead to lower counts next season if sea surface temperatures continue to drop.

- Madden-Julian Oscillation, which is associated with an upper-air wave that moves across the tropics every 30 to 60 days, will continue to drive periods of activity in 2020. It is important to watch these waves move from the western Pacific into the eastern Pacific, as they will ultimately help named storm formation in the Atlantic Ocean.