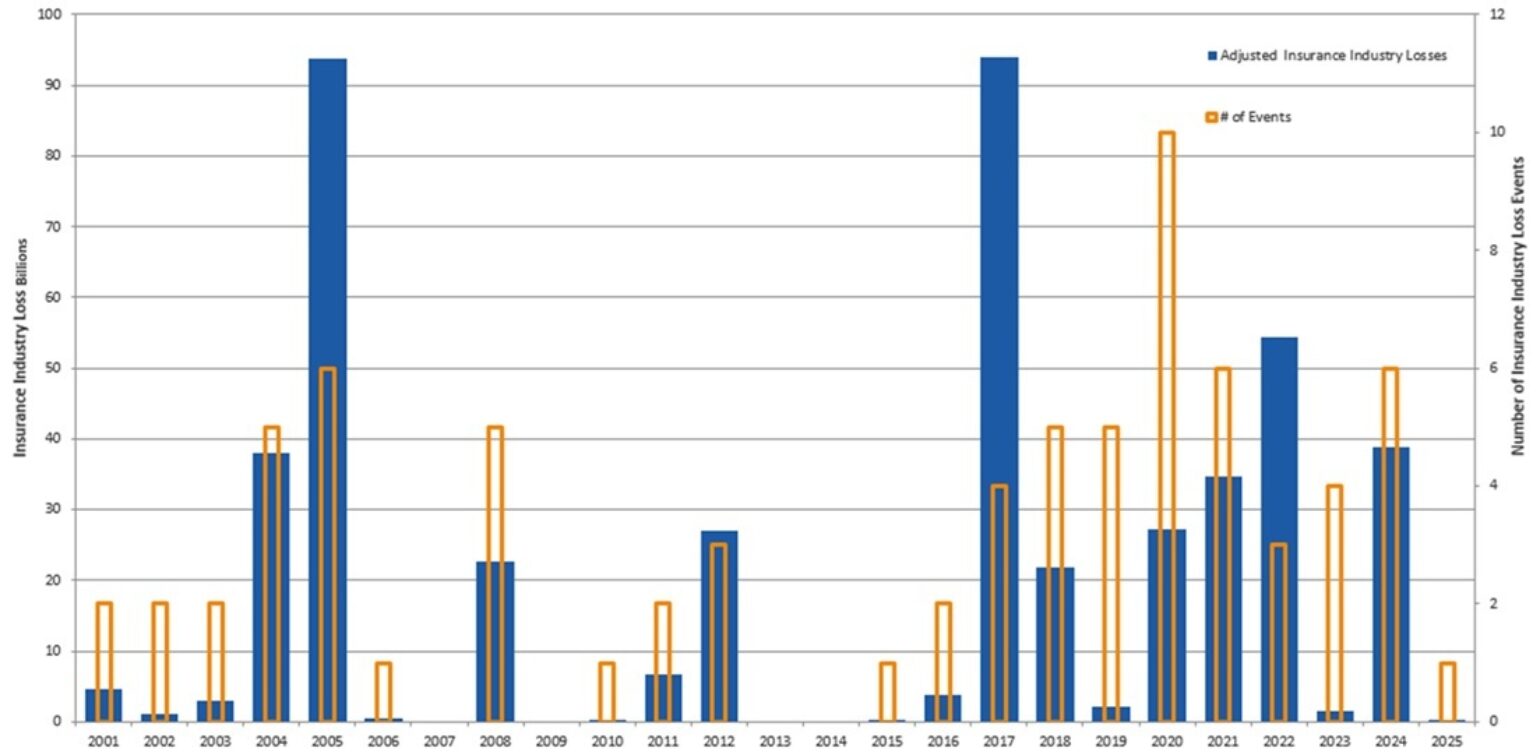

Surprise start to 2025 with the third-largest insurance loss in recent history

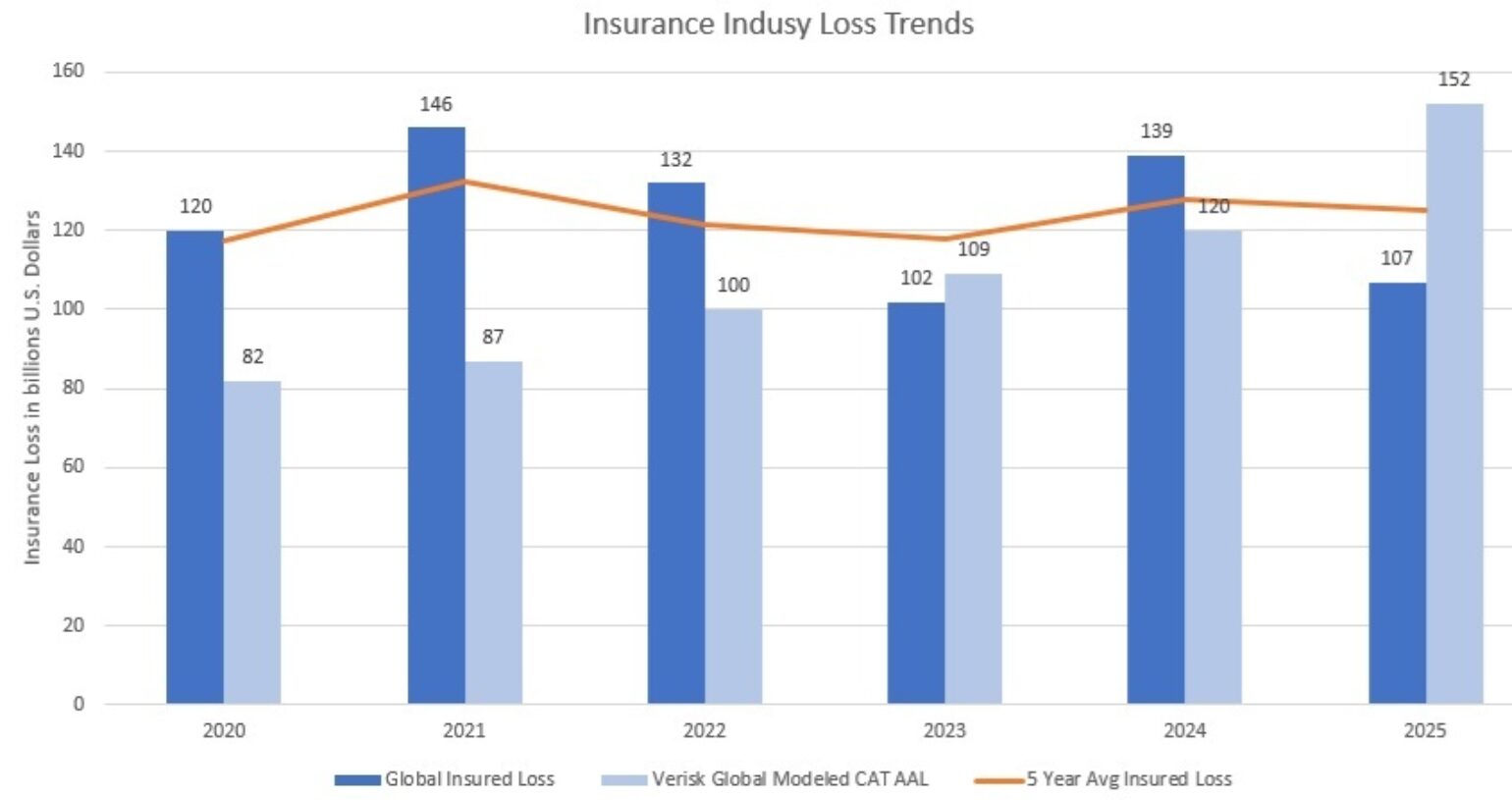

The majority of these BMS Insights examine the Tropical Atlantic and overall hurricane impacts on the U.S., and for good reason: named storms account for 36.2% of total U.S. insurance industry losses over the last 10 years. However, 2025 presented a very different story, which is why this BMS Insight will take a closer look at key takeaways on how natural catastrophes are shaping the insurance industry. In fact, as we entered January 2025, the insurance industry was in shock at a $40B wildfire loss from the Palisades and Eaton Fires near Los Angeles. To put this in perspective, when adjusted for inflation, only two loss events since 2000 have reached a comparable magnitude: Hurricanes Katrina (2005) and Ian (2022). Add to the fact that the industry was facing this type of loss in January, and from a wildfire at that, it was a real shock going into 2025, coming out of an already active 2024 with high insurance losses across natural catastrophes.

Wildfire everywhere but only one industry loss event

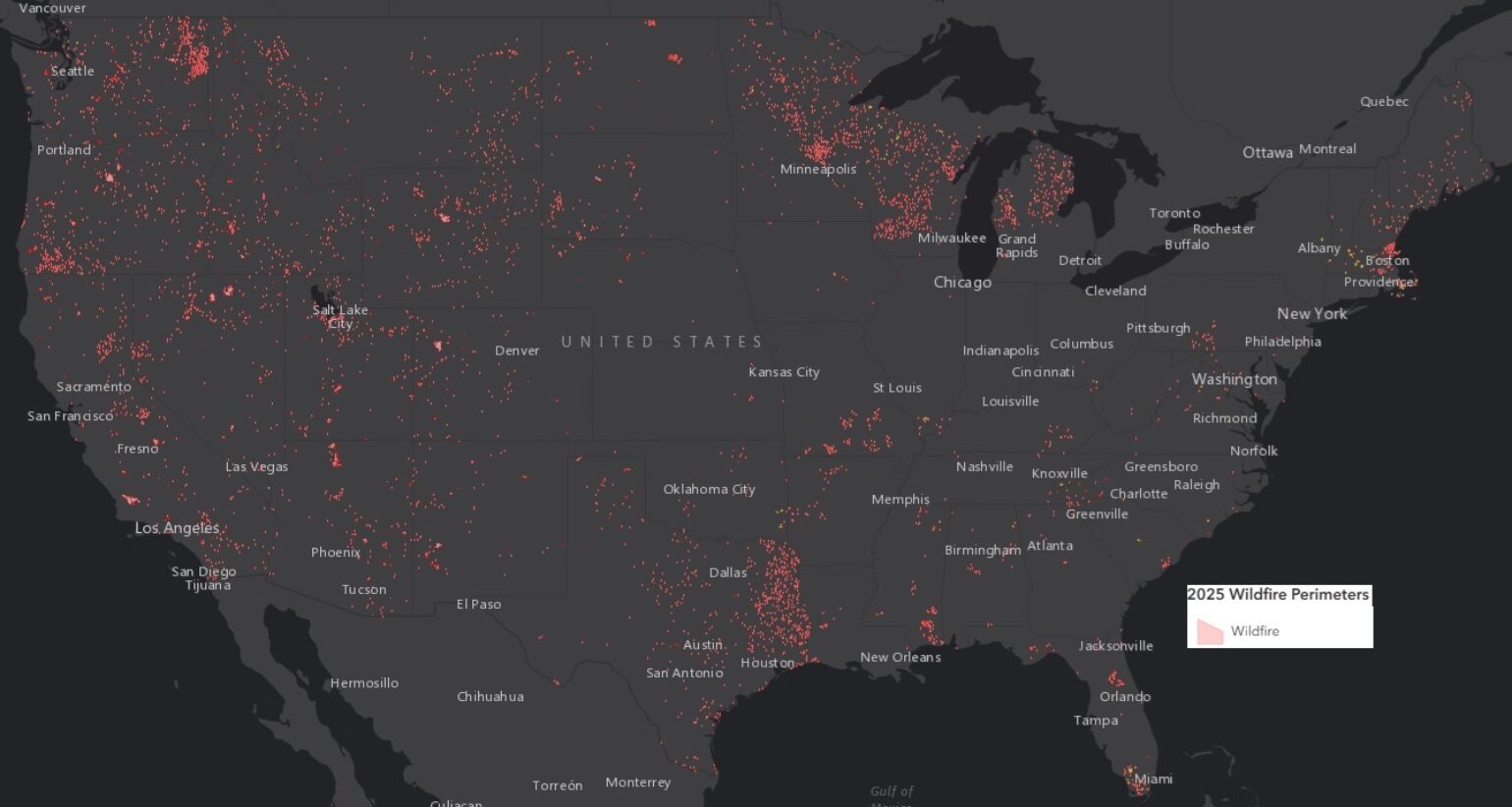

What is interesting is that, for wildfire year-to-date, according to the National Interagency Fire Center Statistics, there have been 63,880 fires, totaling over 4.94 million acres burned. When compared to the 10-year average year to date, 56,349 fires which typically burn about 7.29 million acres. While there have been about 113.3% more fires this year, overall, the acres burned by those fires have been smaller. Outside of the January Los Angeles large wildfire losses, there have been no other large wildfire loss events to the U.S. insurance industry.

As the map below indicates, wildfires are not just a West Coast problem. Many areas can have small and large wildfires. Most wildfires across the U.S. are small, but under the right weather conditions, even a small wildfire can quickly become a problem for the insurance industry in areas outside the Western United States. The industry needs to be vigilant about exposure concentration in even medium-risk wildfire areas.

Severe Weather Losses Not So Bad

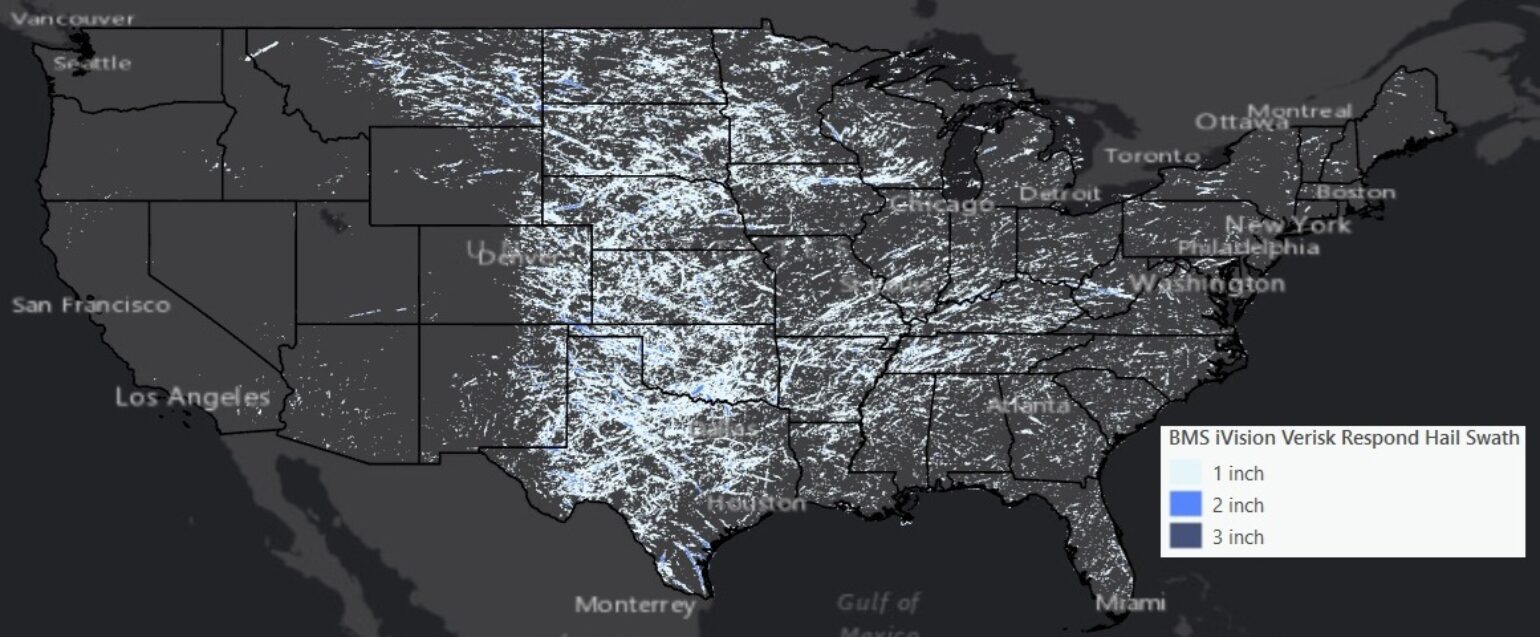

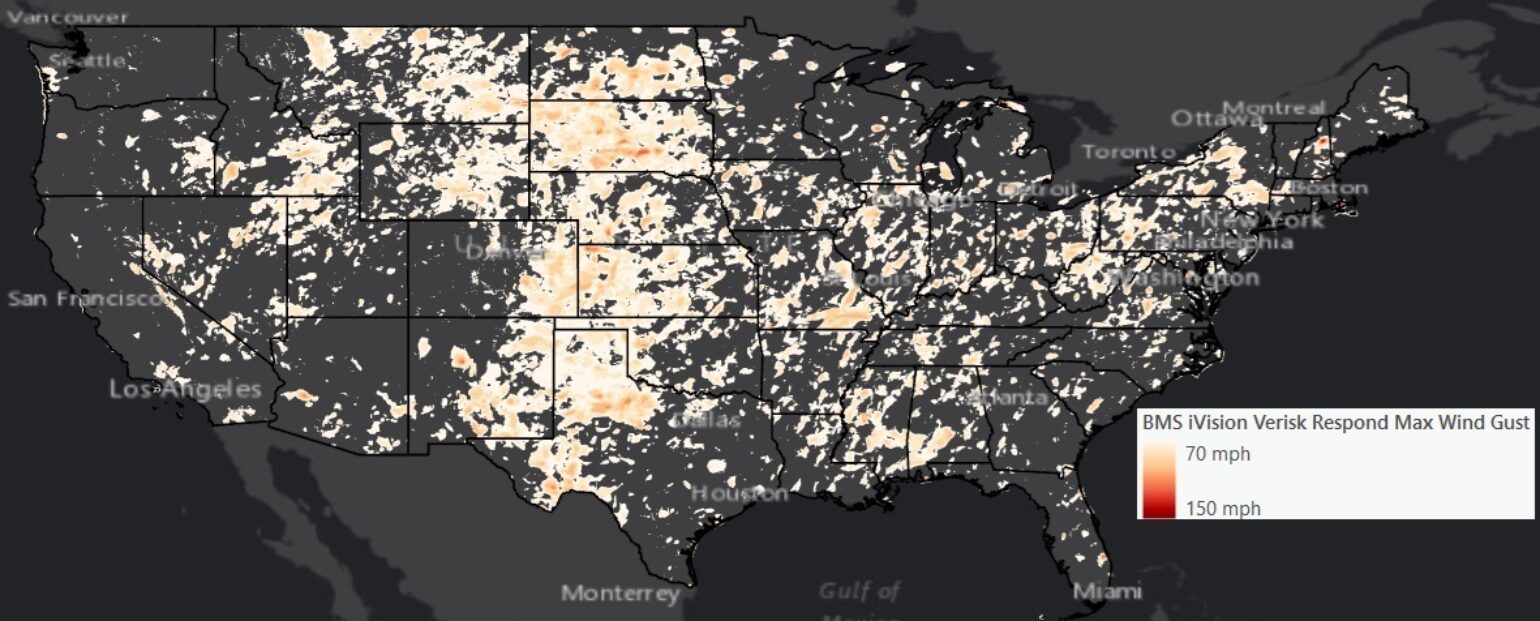

Severe thunderstorms—now a familiar driver of insurance losses—are producing elevated losses this year, running about 113% above the 10-year average, though still well below the $50B+ losses recorded in each of the past two years. It's not to say that the thunderstorm wasn’t impactful this year; it was the most impactful peril in terms of U.S. insurance industry loss. Using the Verisk Respond aggregated PCS peril maps within the BMS iVision platform, we can identify the locations experiencing the most severe wind and hail events in 2025, which are shown in the two maps below.

While severe weather in the first half of the year is expected, Q1 once again proved unusually active; following the surprise upside of the January Los Angeles wildfire losses, multiple severe weather outbreaks—led by the March 14–16 event—which accounted for 17% of total 2025 severe thunderstorm losses. In general, there were 11 severe thunderstorm loss events exceeding $1B, consistent with the average number of such events over the last 5 years.

The overall lower level of severe weather-related losses in 2025 compared to 2023 and 2024 appears to be driven by fewer hail events. According to the Storm Prediction Center, hail reports are running slightly below normal, but wind reports are the third most recorded since 2010, and tornado reports are the fourth most recorded since 2010. However, with severe weather, there is always an element of luck, and 2025 presented plenty of what-if scenarios for the industry to gain an understanding of how severe weather losses could have been. For example, what would have happened if the May 16th St. Louis, MO tornado hit a more affluent part of the city? How have scenarios around the May 28th Austin, TX hail and microburst, and new strategies for deductibles and roof replacement, performed?

With the industry now armed with five major catastrophe modeling vendors that have updated their views of risk for the severe thunderstorm peril, there are even better tools for understanding more granular, property-level pricing, which can polarize physical characteristics like roof age and detailed vulnerability aspects. This insight could help incentivize policyholders to adopt more resilient building standards for thunderstorm risk, as the overall risk is better understood, and how to mitigate a loss that could result in a lower paid premium.

Lack of Hurricane Landfalls

In our preseason BMS Tropical Update, we highlighted two unique records at risk for the 2025 Atlantic Hurricane season, which could have significantly impacted insurance industry losses. One was whether the U.S. would break the record for the most consecutive seasons (Five) with at least 1 major hurricane landfall. And the other focused on whether the New England hurricane drought would continue; it is about 3x overdue, since Hurricane Bob made landfall in 1991. Now that the season is over, the Northeast hurricane drought does continue, and because the U.S. insurance industry only had 1 named storm landfall, Tropical Storm Chantal, the five-year stretch of major U.S landfalls between 2020 and 2025 stands. Tropical Storm Chantal, which impacted the Carolinas, amounted to just over $100M, which is a nice reprieve given the high level of losses since 2016. Although the most significant impact from Chantal was flooding, its flooding impacts were overshadowed by the Texas Hill Country flooding that occurred just a few days earlier.

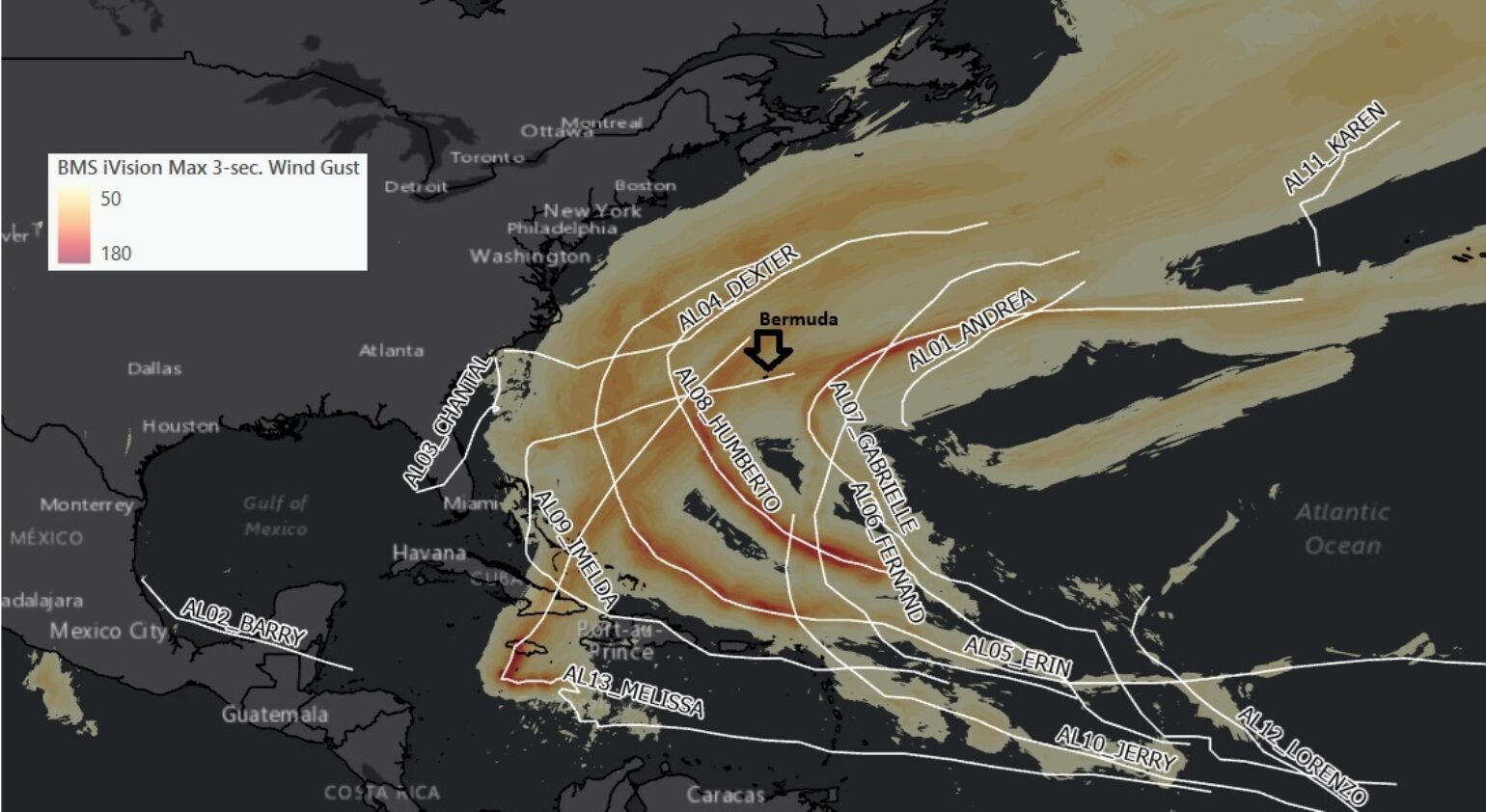

As our BMS Tropical Updates noted, Hurricane Melissa, which made landfall in southwest Jamaica on October 28th, is likely one of the strongest hurricanes to ever make landfall in the Atlantic basin. It was the Atlantic Basin’s costliest hurricane of the year, driving $2.5–$5B in insured losses and leaving enduring impacts across parts of the country. Despite bullish predictions at the start of the season, this year’s hurricane season was relatively normal, with five hurricanes, four of which were considered major and three Category 5: Erin, Humberto, and Melissa. The overall proportion of hurricanes to major hurricanes was high, contributing to the season's above-average Accumulated Cyclone Energy (ACE) index and the highest ACE per hurricane since 1932. Besides Melissa, the other area that saw significant activity this hurricane season was the small island of Bermuda, which is remarkable given how large the Atlantic basin is relative to the island's size. Below is a look at our BMS iVision Verisk Respond aggregated highest 3-second wind gust observed over the basin this season, and Bermuda surely saw its fair share of activity with three bypassing hurricanes.

As an industry, we must address named storm activity as a global phenomenon; while attention often focuses on the Atlantic Basin, meaningful insights into changing storm patterns need a global perspective. While there is a popular hypothesis that future changes will result in fewer storms but a greater proportion with higher intensities, as seen this year in the Atlantic basin, this does not appear to be the case globally in 2025. Global activity for major hurricanes was below average. However, it is landfall that matters this year; the lack of U.S. landfalls clearly drives much lower worldwide insurance losses, with other landfalls driving large flooding events in areas like Southeast Asia.

Flood Events On The Increase

As the world warms, there is one connection that seems certain globally. A well-known relationship exists between a warming world and the amount of moisture that air can hold. This is due to the Clausius–Clapeyron relation, which is the thermodynamic relationship between atmospheric temperature and water vapor content. Generally, when the temperature increases (decreases) by 1°C, the water-holding capacity of the atmosphere will increase (decrease) by about 7%. Warm air can hold more water vapor, which, in return, releases more liquid water as rain.

2025 has been marked by an unusually high number of severe floods and heavy rainfall events worldwide, resulting in thousands of deaths, massive displacement, and economic losses that are difficult to quantify but likely exceed hundreds of billions of dollars. This is related to the clustering of two named storms and a typhoon recently in Southeast Asia, which is attributed to causing one of the most impactful natural disasters in 2025 with an estimated 1,100 to 1,300 deaths and millions affected and displaced. There were many other flood events spanning multiple continents. While some of these flood events are driven by named storm activity, others are driven by glacial lake outbursts and prolonged monsoon rains, amplified by atmospheric moisture and severe thunderstorms.

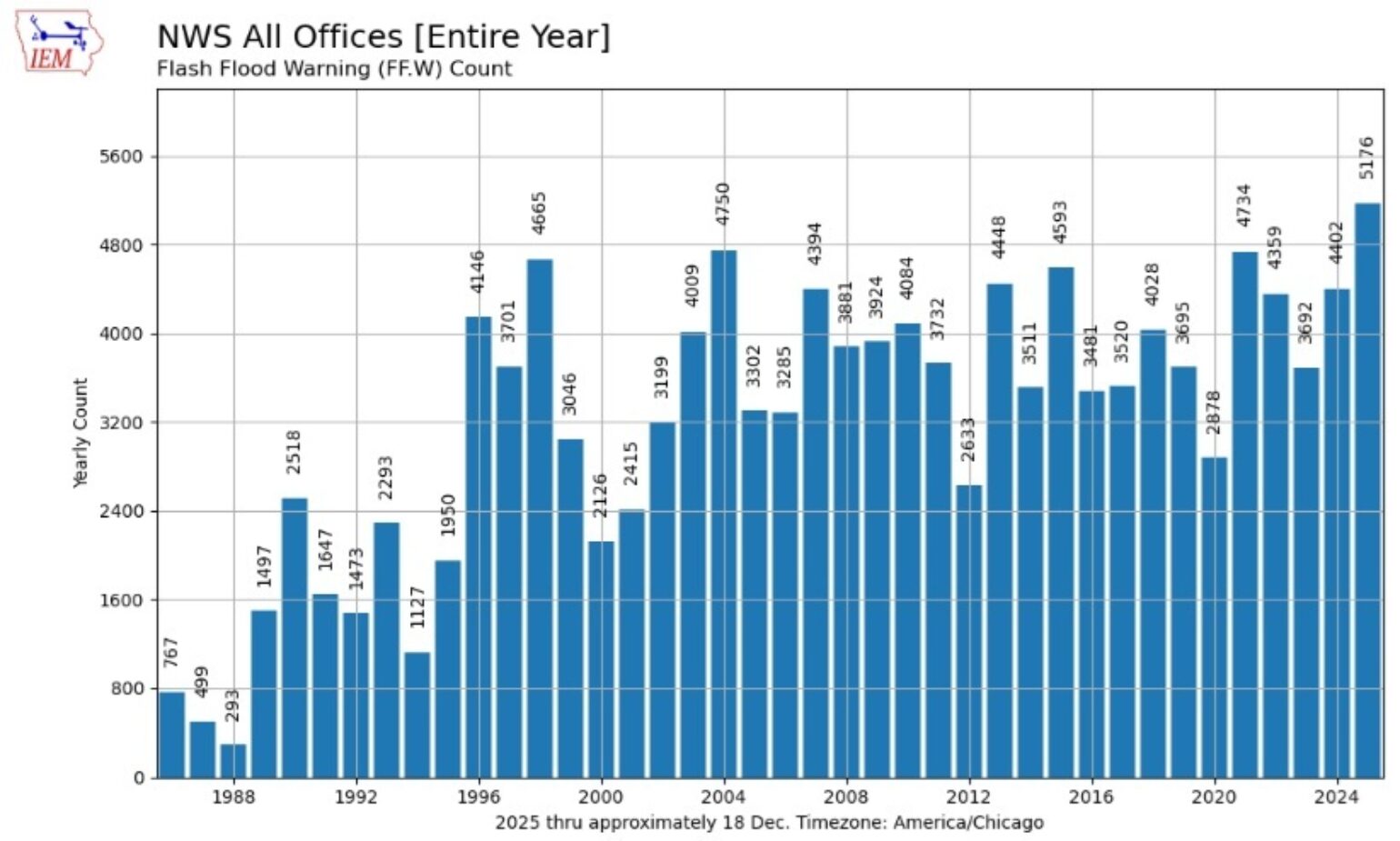

The U.S. experienced a record-breaking year for flash flood warnings issued by the National Weather Service, with nearly 5,176 flash flood warnings issued, the highest since records began in 1986. The previously mentioned Texas Hill Country flooding on July 4th along the Guadalupe River killed 120–135 people and caused $18–22 billion in economic damage. However, limited insurance loss highlights the protection gap that still exists around the world. In the U.S., only 3.3% of homes have active flood insurance through the National Flood Insurance Program (NFIP). Given the government shutdown and the program's future, there is a significant opportunity for private flood insurers to fill this gap.

Earthquake Events Normal

This BMS Insight started talking about the large Los Angeles wildfire that shocked everyone, and earthquakes continue to always be a surprise. The U.S. is still waiting for the big one in the Los Angeles basin. Nevertheless, the insurance industry and relatively populated areas were fortunate that most major earthquakes had limited impacts, which helped keep insurance losses lower in 2025.

Long-term records from the U.S. Geological Survey (USGS) show that major earthquake frequency remains largely constant over time. On average, the world experiences about 16 major earthquakes per year, withroughly about 15 in the magnitude 7.0–7.9 range and one magnitude 8.0 or greater occurs in any given year, which is what we experienced this year worldwide. Strongest Event: A magnitude 8.8 earthquake struck off the Kamchatka Peninsula, Russia, on July 30, 2025. It was the most powerful quake globally since 2011, triggering a Pacific-wide tsunami, but loss of life and damage were limited from this very strong earthquake. Once again highlighting the protection gap, a deadly 7.7 earthquake occurred in Myanmar, causing over 5,000 deaths and displacing millions. The biggest U.S earthquakes were focused on seismically active regions of Alaska, but small non-damaging swarms of earthquakes in California are a reminder to the insurance industry that one day the state will have to deal with a different peril other than wildfire.

2026 Incoming

As we close out the year, looking back on how it started, in terms of natural catastrophe losses worldwide, the insurance industry is taking a sigh of relief. The Los Angeles wildfire has accounted for about 51% of the total loss that the U.S. insurance industry experienced in 2025, which is pretty amazing considering that without the wildfire, the U.S would have an amazingly low loss year, similar to years like 2019 and maybe some of the years with limited hurricane landfalls between 2006 and 2016. Given that most global insurance industry losses originate from the U.S. insurance industry, it is unsurprising that Swiss Re has stated that worldwide insurance industry losses could settle at as low as $107bn. This is quite remarkable considering that the Verisk Global Average Annual Loss suggests losses should be about $184B in any given year, with $32B from Agricultural, leaving $152B expected from other natural catastrophe losses. This low level of worldwide loss is a welcome relief from the higher-loss years of the last two years, and the insurance industry should not be surprised that this will be yet another year of $100B+; it should be a surprise that the losses are far below the expected average annual loss.

It is far too early to predict what will occur in 2026, as the bingo card of natural catastrophic events includes all sorts of known scenarios that could impact the insurance industry. Our next BMS Insight will examine what climate forces are indicating could occur in 2026, but regardless of what Mother Nature brings, the insurance industry should take a relatively calm 2025 to strengthen prevention, protection, and preparedness, which are essential to safeguarding lives and property.