Winter Storm Impacts Large Swath of the U.S.

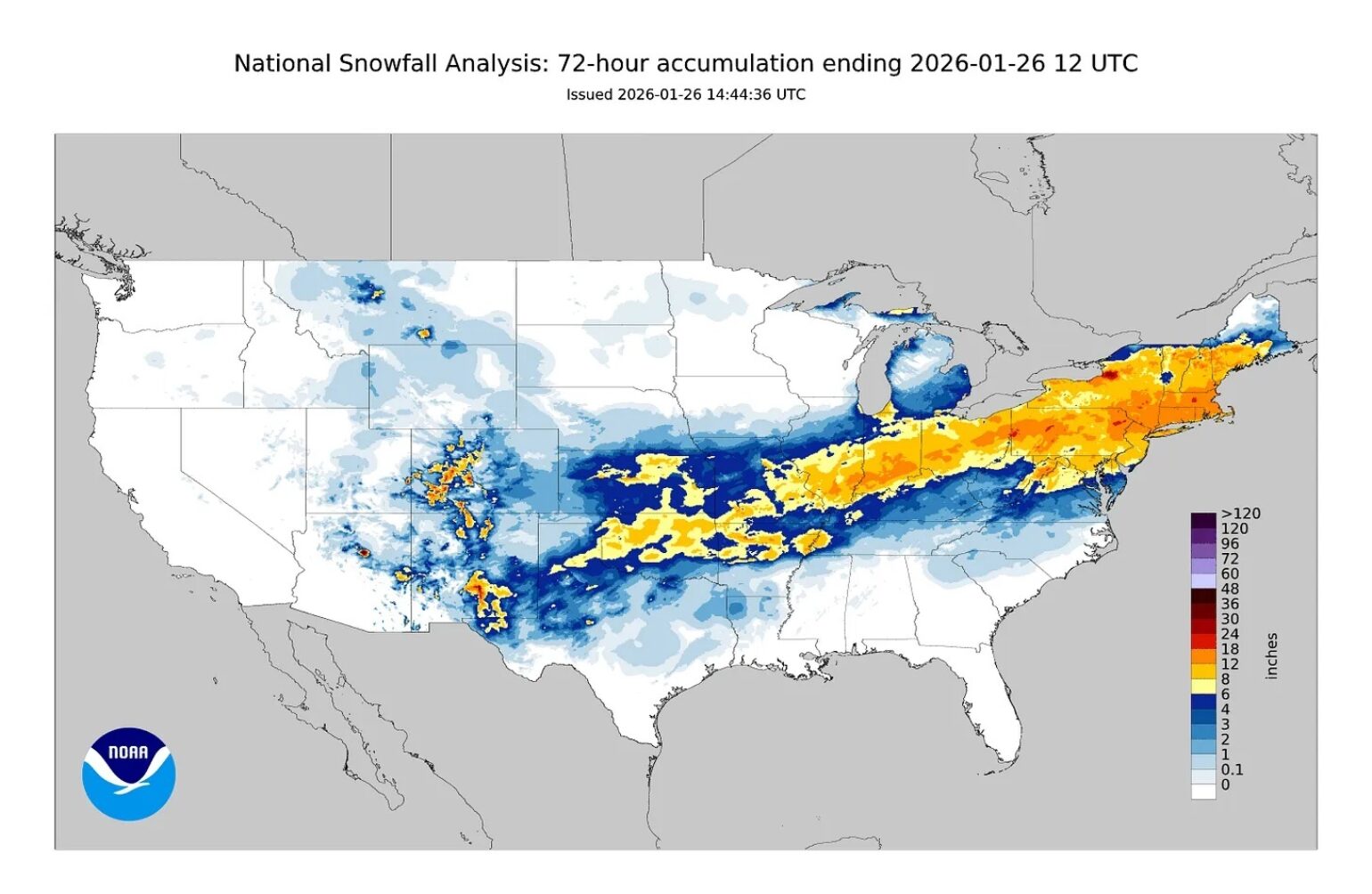

The insurance industry is dealing with a historic winter storm (labeled Fern by the Weather Channel), which has set various records across winter weather perils, impacting over 180M people across the U.S. and Canada, with just under 1M without power at one point. There are plenty of media outlets highlighting the historical significance of the various weather-related impacts from this winter storm, so this BMS Insight will focus more on the unique insurance impacts. However, to summarize a few remarkable stats,. snow cover now shrouds 56% of the Continental United States as of Monday (1/27), which is by far the most snow cover to date this winter season. As much as 6 inches of snow fell across 26 states from New Mexico to New England, and 13 states picked up at least a foot or more of snow. In many areas, this is the biggest snowstorm in 10 years or more. The last time the Northeast Corridor from DC to Boston saw more than 6 inches of snow was 10 years ago, during winter storm Jonas, January 22 – 24, 2016, which today would equate to a $300M loss event to the insurance industry.

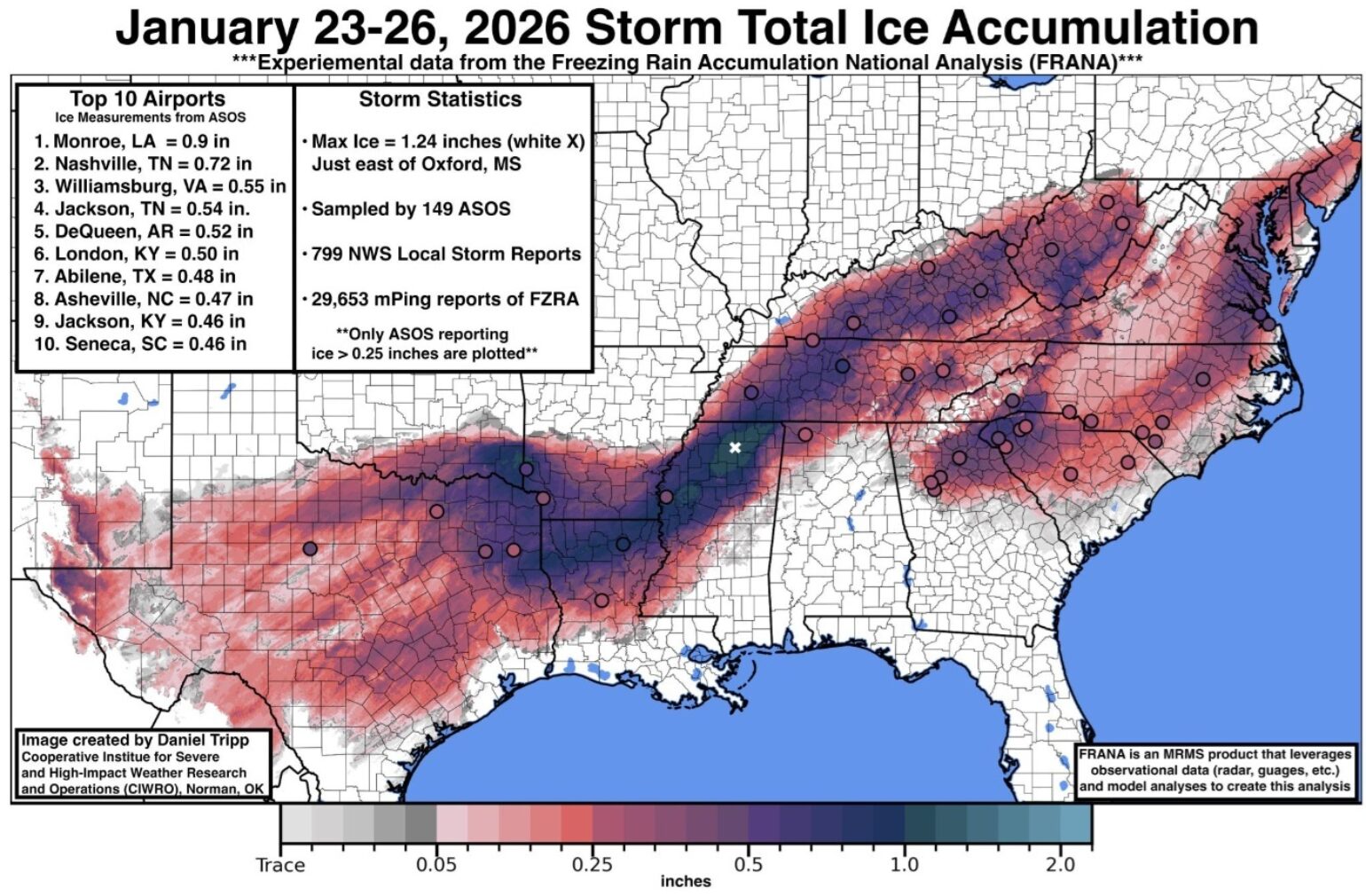

The other notable peril was freezing rain and ice accumulation. NOAA has reported over 700 reports of freezing rain accumulation or ice damage just below the snow line, from Central Texas to parts of Central North Carolina. What made this ice storm so impressive was the extent of 1-inch ice accumulation, with some areas of Northwestern Alabama, Northern Louisiana, and Northern Mississippi showing massive amounts of tree damage, which correlates with the areas hardest hit by power outages.

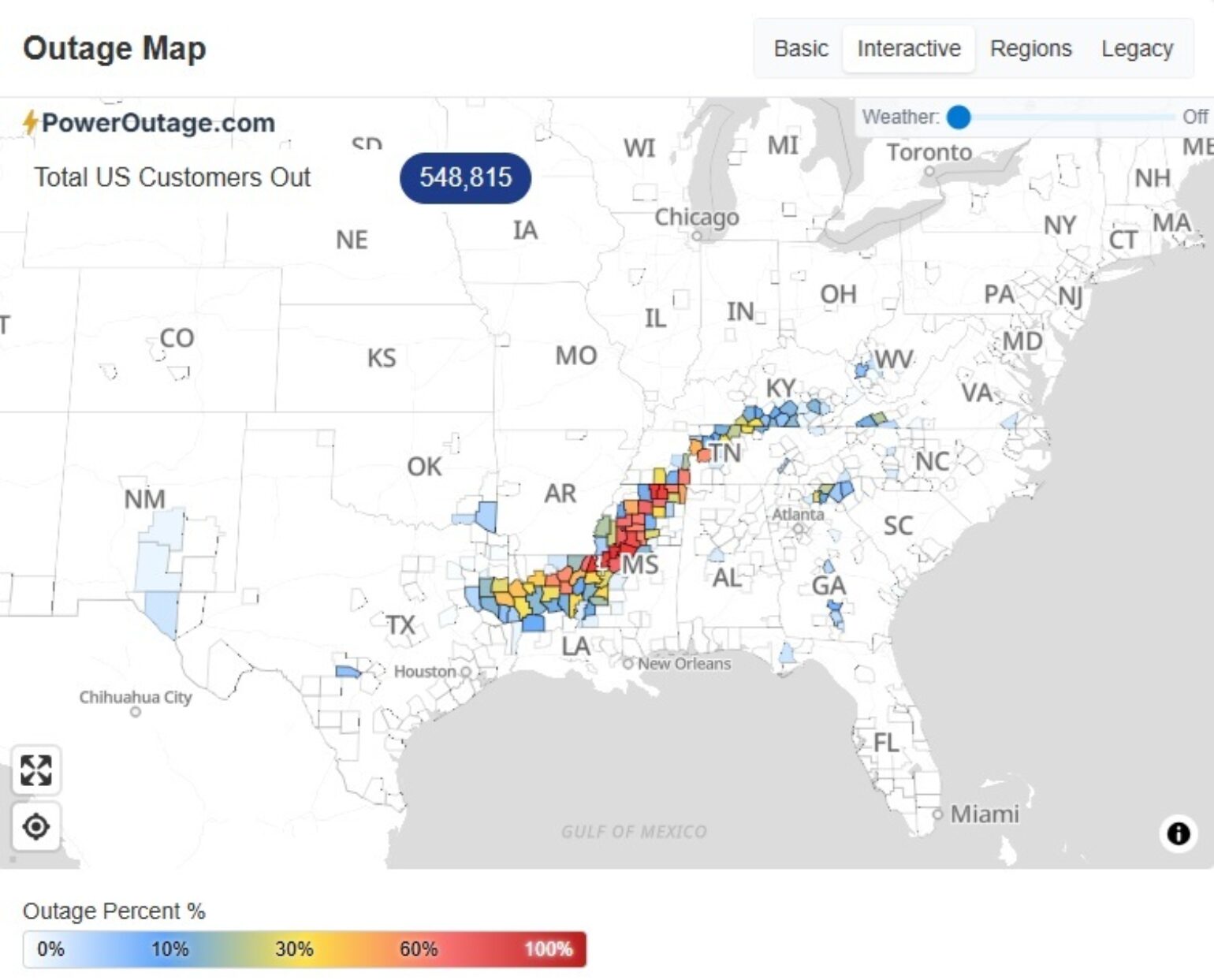

Although the sun will be shining over the next few days, temperatures will struggle to get above freezing in some of the hardest ice-hit areas, as today's poweroutage.us map shows the third day for many, over half a million customers, without power, . Only 29% of customers have been restored in Mississippi and 31% in Louisiana. There are over 22 counties with 50%+ customers still without power. The hardest hit areas in Louisiana and Mississippi have several counties/parishes that are nearly completely without power. In some of these areas, it is estimated that it could take 10+ days before it is restored. Some have suggested the damage from the ice storm might be like the ice storm of December 4th and 5th of 2002, which, today, would equate to about $620M in losses.

Insurance Industry Impacts

Determining the overall insurance from winter perils has its complications. It might just be one of the more complicated perils the insurance industry has to deal with, and it is undoubtedly one of the most challenging for catastrophe risk models. Because of the multiple-peril nature and the way these perils interact, loss calculation often becomes complicated. Hazards frequently include peak wind gust, ice load, snow load, and freezing temperatures. For example, snow vulnerability encompasses more than rooftop accumulation, which is most often linked to roof collapse. Snow is not consistent; it can be wet or light, and the water ratio depends on temperature, which determines its weight, so it never just about the amount of snow. With multiple snowstorm events, snow can accumulate at varying densities. There is, however, generally good building code for snow loads, with residential codes in the northeast often requiring 50-70 pounds per square foot, which, depending again on the density of the snow, is 2-3 feet of packed, wet snow or 6-8 feet of light, fluffy snow.

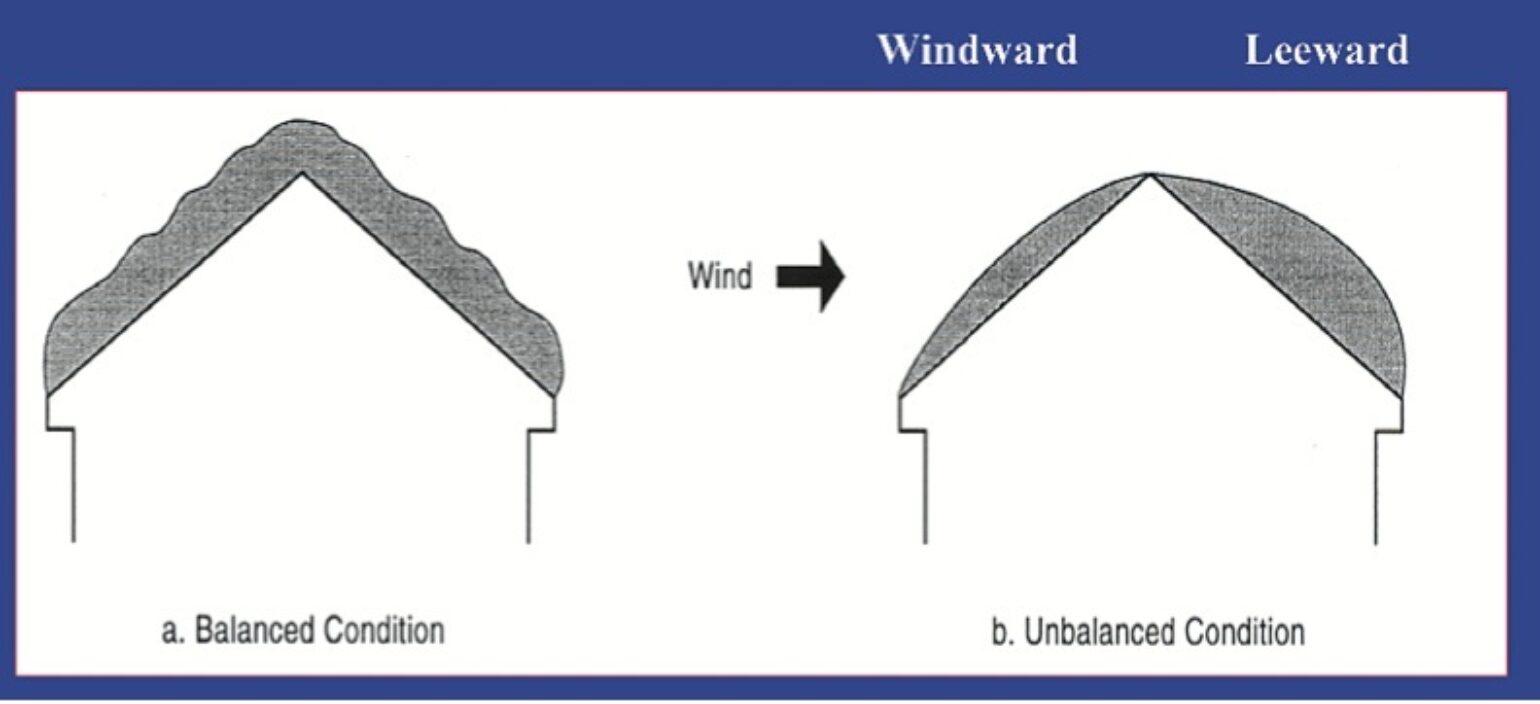

Another example of snow load complications would be adding a wind component. In 2019, in Wisconsin, after a snowy season, many barns and outbuildings collapsed, not necessarily due to snow weight, but rather to a strong wind event that shifted the snow load, which would otherwise have been fine without the wind.

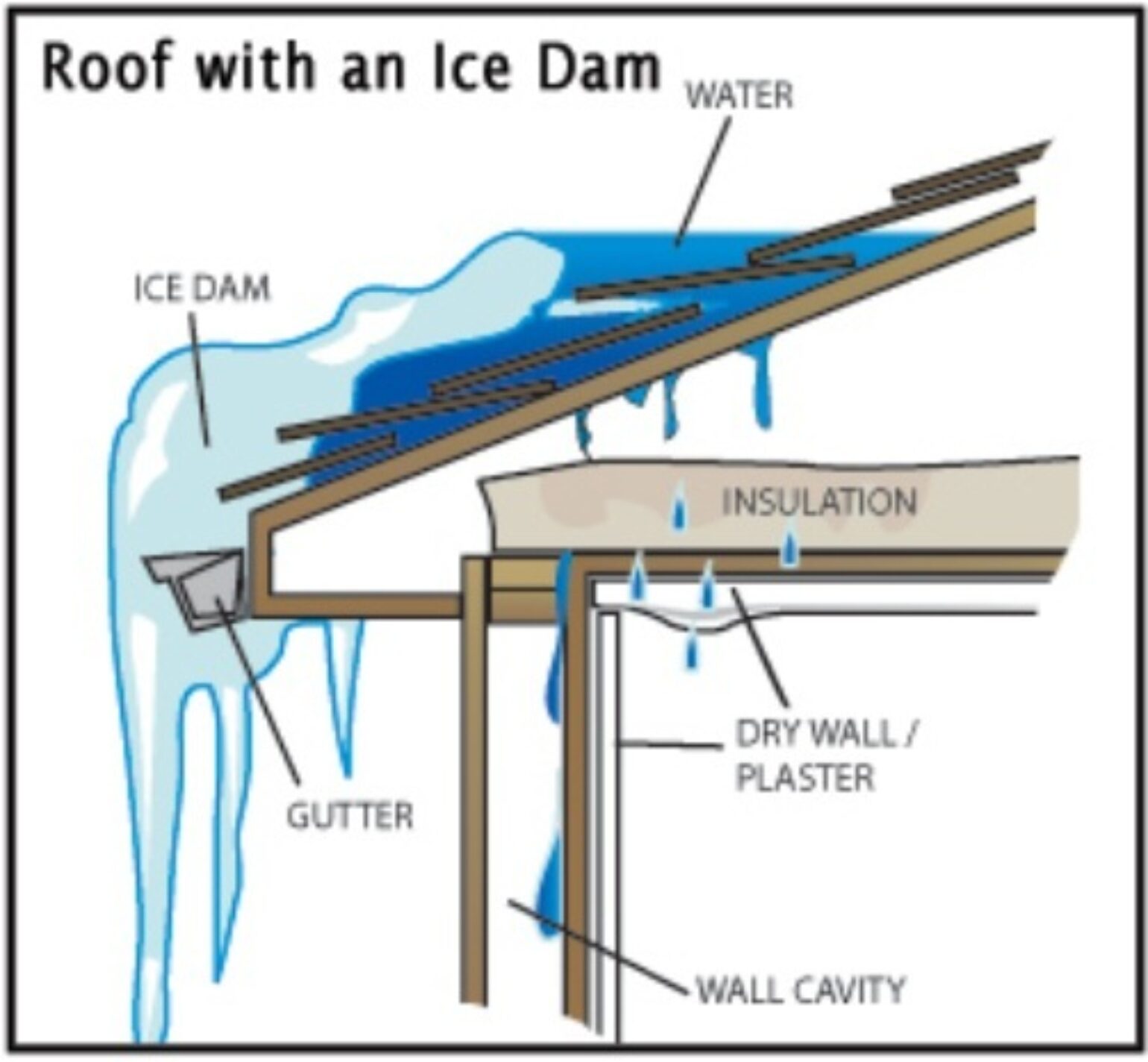

There are distinct damage models for snow-related roof risk, including ice damming, which is further influenced by temperature conditions in the days following a snow event. An ice dam occurs when melting snow, due to heat loss through the attic, refreezes and forms a dam, backing up water under the roofing material and causing water damage in the ceiling or walls. These types of claims can happen weeks after the initial event, the date of loss, and the aggregation of an event can then be difficult for insurance carriers to determine.

These are just some of the complications from snow, but there are other factors, such as freezer contents losses or business interruption for commercial risks. Auto insurance claims rise sharply during winter weather, even as drivers limit travel. As conditions improve, lingering cold can create black ice, driving renewed risk when vehicles return to the roads. Lastly, homeowners and business owners may increasingly be held liable for slips and falls on ice that was not properly treated, leading to more liability or medical claims. These examples illustrate how difficult it is to model and estimate winter storm losses from specific events, and this latest event appears to combine all the risk factors, making it potentially costly.

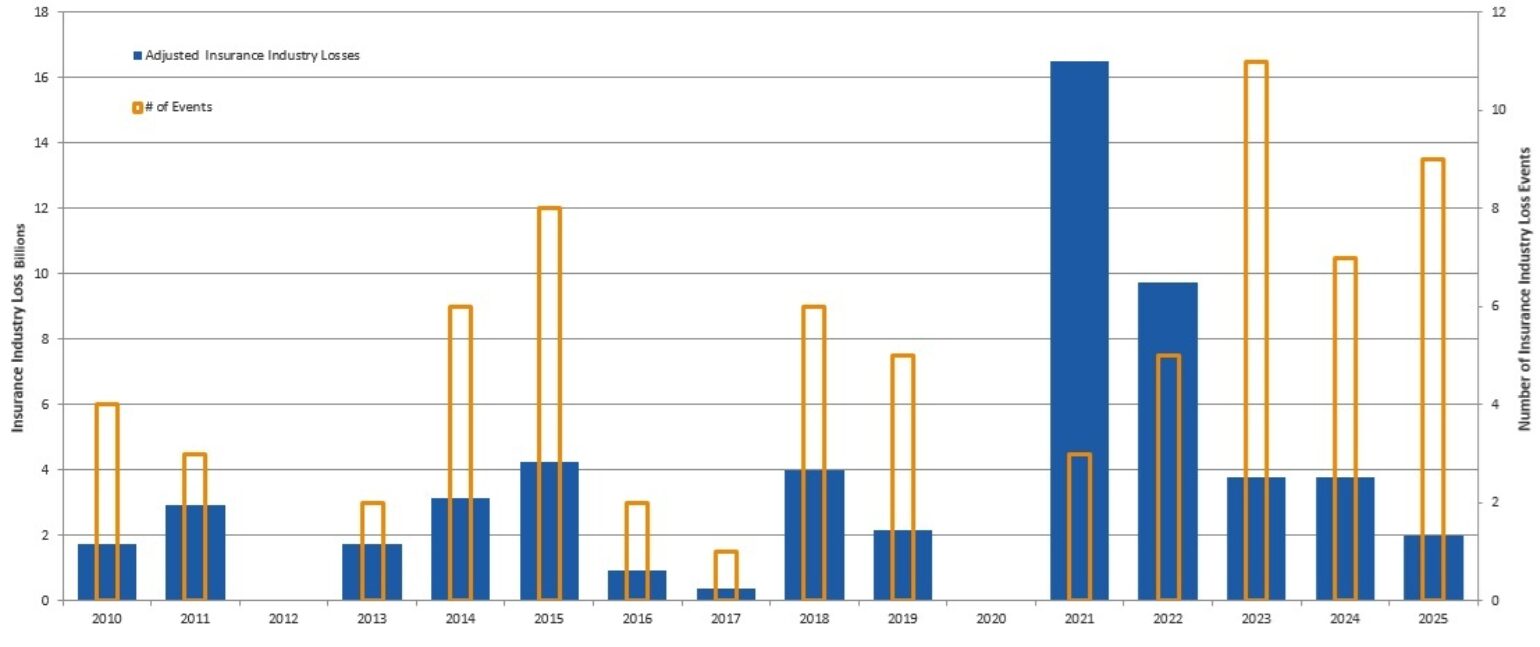

Winter Storm losses tend to make up about 6% over the overall modeled average annual loss from catastrophe risk models. Over the last three years, since 2023, the insurance industry has, on average, experienced 9 winter storm events per year, with an average loss of about $375M. Over that same period, about 24% of the events resulted in insurance industry losses exceeding $500M. Having an upsize insurance loss often points to events affecting more urban population centers and triggering cascading losses due to the number of power outages they cause. Looking back at the major industry loss events of 2021 and 2022, two of the costliest years for winter storm losses were largely due to the large number of power outages associated with those events. Most of the industry remembers what happened in 2021 with Winter Storm Uri, when the majority of the state of Texas lost power for days. In total, about 5.2M customers were without power during the peak of the winter weather in February 2021. This latest winter storm is not as cold across Texas as in 2021 to put the strain on the overall power grid. The other reason the power has stayed on is the reforms enacted by the Texas legislature to improve electricity reliability, including renewables, battery storage, and much more reliable natural gas generation.

Maybe to a lesser extent, but just as impactful, was winter storm Elliot, which occurred over the Christmas period in December 2022, affecting about 1.6M customers and knocking out power. What compounded the power losses was that many businesses were closed due to the holiday, so pipe leaks went undetected. Both Uri and Elliot were multi-billion-dollar events and unique, just as this winter storm is, but at this time, insurance industry losses shouldn’t reach the level of these two historic events.

Luckily, weather memories are short, and the memories of 2021 or 2022 have helped lead to loss-prevention strategies for extreme winter weather. This winter storm was well-advertised in advance, giving policyholders across all lines of business plenty of time to prepare by taking precautionary steps to limit winter weather-related losses. BMS Group is an IBHS member and has a wealth of resources on building resilience against winter weather.

Another silver lining to insurance losses from this event is that some of the largest population areas were not impacted by severe ice as previously feared. Areas like Dallas and Atlanta seemed to dodge the harshest impact of the ice storm. However, with so many without power, the rural nature of the impacts shows just how extensive and impressive the number of outages is. Severe ice storms impacting rural areas can still add up to insurance industry loss. Last year, a devastating late-season ice storm impacted rural northern Michigan across 25 counties between March 28 and 30th, resulting in over $80M in damage. Whereas that was a relatively small area with limited population, when compared to the large swath of ice storm impacts from this storm, the losses here will add up to several hundreds of millions of dollars. As mentioned, winter storm losses can be complicated, and what further complicates this event is the extended cold just now occurring. The extended cold, coupled with widespread power outages, will add to the longer claim period from this winter storm and complicate the date of loss. The extended cold will also contribute to ice dam build-up in many areas that received significant snow over the last few days, once again delaying claims and complicating the date of loss, which will be further impacted by next week’s forecast. .

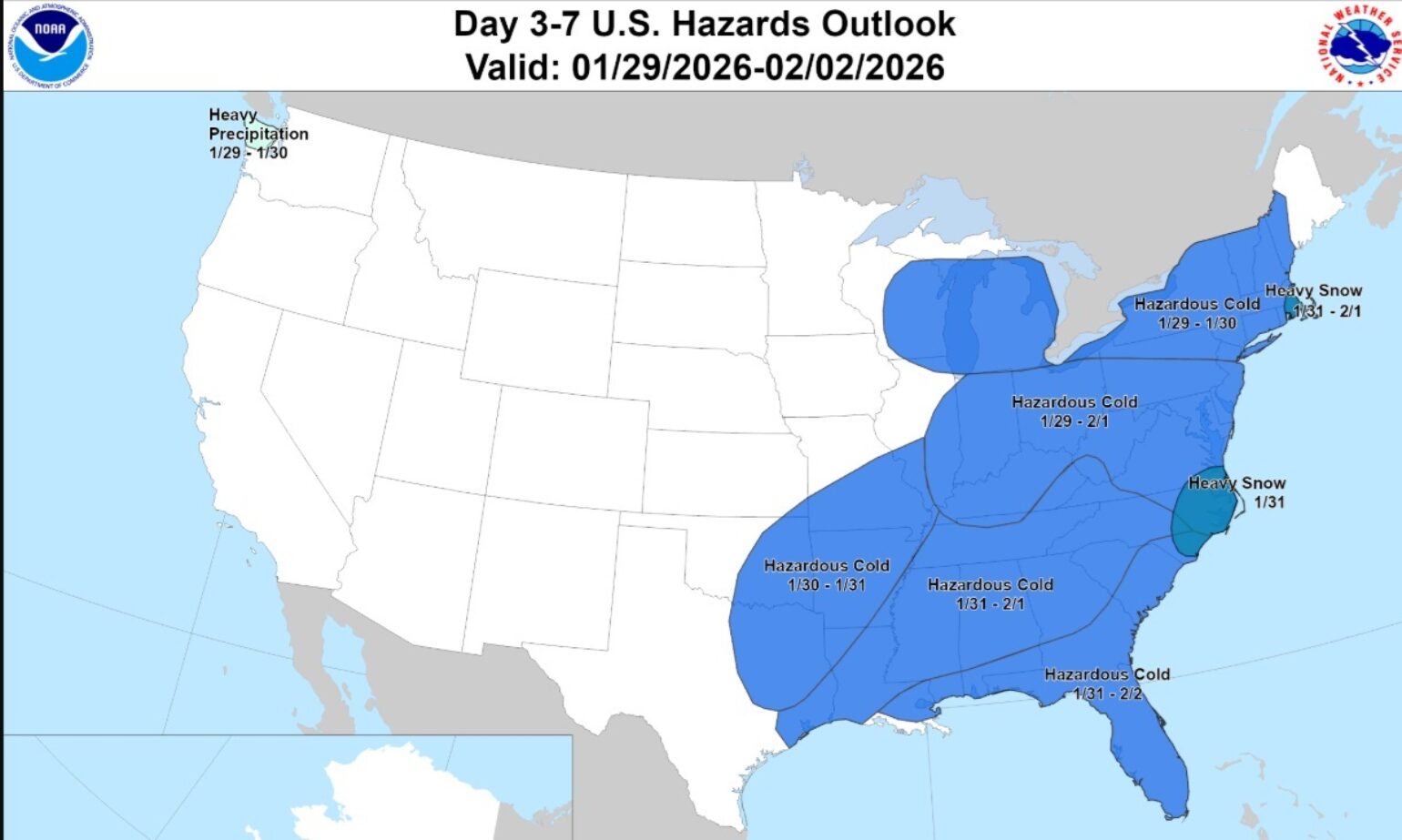

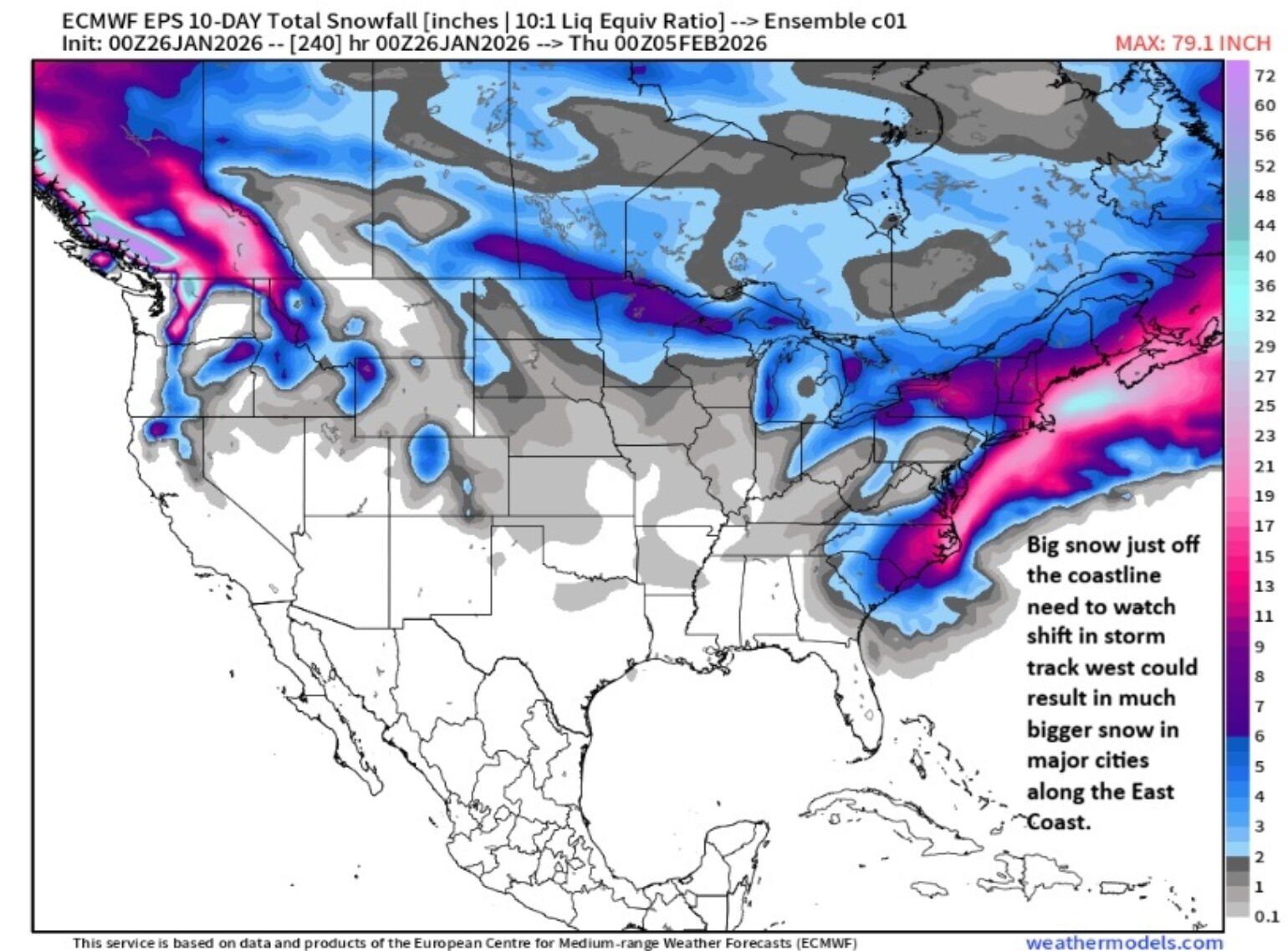

Here we go again

The atmosphere is primed to deliver yet another major winter event this weekend, spanning New York City to Boston. With increasing confidence, a large, powerful nor’easter will spawn a blizzard off the East Coast this weekend, with heavy snow that will further increase the potential for snow loading and ice dams. With more extreme cold gripping the eastern U.S. into next week, winter isn’t going away, but we know the groundhog will have the final say next Monday in how long it sticks around.

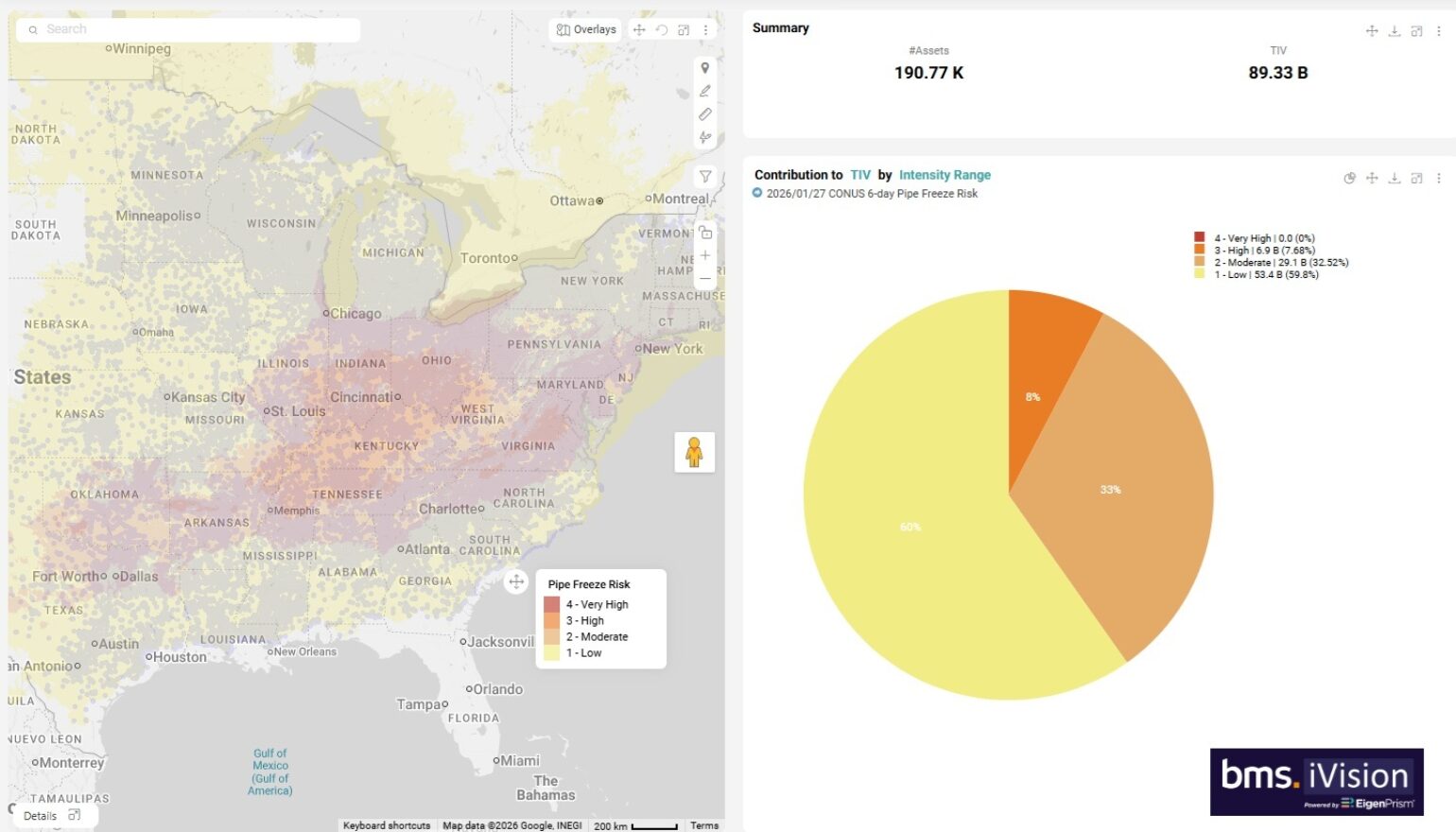

Here at BMS, we are helping insurance clients make sense of forecasts of ice, snow, and cold with real-time alerts to identify risk and, through proactive communication, help carriers prevent losses.

Just one example is that we work with EigenRisk Inc. and Adiabat Weather, whose pipe-freeze product predicts pipe-freeze risk and alerts BMS clients to potential severity. Right now, their model shows a broad swath of high risk for this latest outbreak. However, beyond 6 days, a much more significant cold-air outbreak occurs in the first week of February. Regardless, now is the time to be aware of the risks and potential for large losses, as well as the complexities of winter weather-related losses.